Blockchain compliance is no longer optional for businesses – it’s a must. Noncompliance can lead to fines, reputational damage, and even shutdowns. Enterprises need to align with legal, regulatory, and operational standards when using blockchain technology. This includes managing on-chain elements like transaction tracking and off-chain requirements such as AML/KYC policies and regulatory reporting.

Key Takeaways:

- Why Compliance Matters: Avoid fines (up to $100,000/day in some cases), protect your reputation, and ensure operational continuity.

- Compliance Areas: Governance, AML, sanctions, and data privacy are critical focus areas.

- US Regulations: Agencies like the SEC, CFTC, and FinCEN enforce specific rules for tokens, derivatives, and financial crime prevention.

- Global Challenges: Cross-border rules like the EU’s MiCA and FATF’s Travel Rule require businesses to meet international standards.

- Building Compliance Programs: Combine clear policies, risk assessments, and monitoring tools to stay ahead of regulatory demands.

Bottom Line: A well-structured compliance framework is essential for businesses leveraging blockchain. From managing risks to meeting global regulatory requirements, enterprises must integrate both technical and legal solutions to ensure success.

Blockchain Governance, Security and Compliance in the Age of WEB 3 | AWS Public Sector

Regulatory and Legal Frameworks

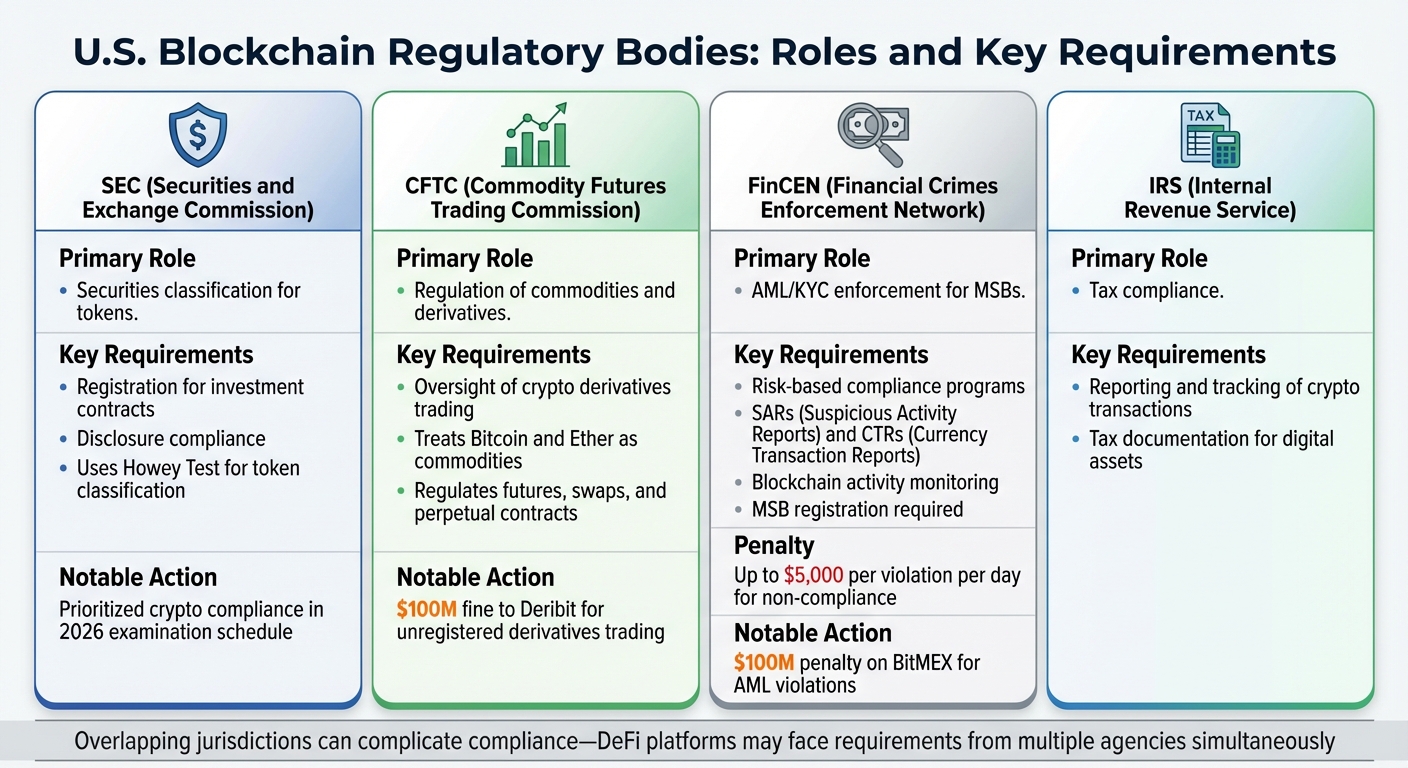

U.S. Blockchain Regulatory Bodies: Roles and Key Requirements

U.S. Regulatory Bodies and Laws

In the U.S., blockchain regulation is divided among several agencies, each overseeing specific areas. The SEC focuses on determining whether tokens qualify as securities using the Howey Test. If tokens are issued with promises of value appreciation, they often fall under SEC scrutiny, requiring registration or reliance on exemptions like Regulation D[3][5]. Meanwhile, the CFTC treats Bitcoin and Ether as commodities, regulating crypto futures, swaps, and perpetual contracts while enforcing anti-fraud rules in spot markets[3][5]. FinCEN, under the Bank Secrecy Act, identifies crypto exchanges and custodians as Money Services Businesses (MSBs). These entities must implement AML/KYC programs, file Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs), and monitor activities like the use of mixing services or interactions with sanctioned addresses[3].

The overlapping jurisdictions of these agencies can complicate compliance. For example, a DeFi platform offering perpetual contracts could face requirements from the SEC, CFTC, and FinCEN simultaneously. Non-compliance with MSB registration alone can result in fines of up to $5,000 per violation per day[3]. In 2025, the SEC emphasized crypto compliance in its 2026 examination schedule, prioritizing token classifications, custody rules, and risks at the intersection of AI and Web3[9][10]. The CFTC also advanced rules targeting DeFi governance tokens and liquidity providers as potentially regulated entities[3][9].

| U.S. Regulator | Primary Role | Key Requirements |

|---|---|---|

| SEC | Securities classification for tokens | Registration for investment contracts; disclosure compliance[3][5] |

| CFTC | Regulation of commodities and derivatives | Oversight of crypto derivatives trading[3] |

| FinCEN | AML/KYC enforcement for MSBs | Risk-based compliance programs, SARs/CTRs, blockchain activity monitoring[3] |

| IRS | Tax compliance | Reporting and tracking of crypto transactions[3] |

State-level rules, like New York’s BitLicense, add another layer of complexity. This stringent regime requires extensive applications, including business and compliance plans, with approval taking anywhere from six months to two years and costing over $100,000 in fees[3]. Recent enforcement actions highlight the importance of early token classification. For instance, the CFTC fined Deribit $100 million for unregistered derivatives trading, while FinCEN imposed a $100 million penalty on BitMEX for AML violations[3].

Global and Cross-Border Compliance

Operating across borders adds even more challenges. The EU’s MiCA (Markets in Crypto-Assets) framework, effective in 2024, introduces a unified licensing system for crypto-asset service providers (CASPs) across its 27 member states. It covers AML/KYC, reserve requirements, and rules for stablecoins[11]. U.S. companies serving EU users must either comply with MiCA or geofence their platforms to block access[6]. Additionally, FATF’s Travel Rule requires Virtual Asset Service Providers (VASPs) to share originator and beneficiary details for transactions over $1,000/€1,000 – a task complicated by blockchain’s pseudonymous nature[7]. In Brazil, new Central Bank resolutions mandate that VASPs meet capital requirements ranging from BRL 10.8 million to BRL 37.2 million (approximately $2–6.9 million), starting in late 2025[7].

The EU’s GDPR presents another unique challenge. Its "right to erasure" conflicts with blockchain’s immutable nature, pushing companies to adopt hybrid solutions that separate sensitive data from the ledger[2][6]. Privacy-preserving technologies like zero-knowledge proofs offer potential solutions for compliance. Additionally, data localization rules require that certain data remain within EU member states, complicating operations for globally distributed blockchain networks[2][7]. Enterprises also face jurisdictional risks, as routing transactions through less-regulated regions could lead to penalties from agencies like OFAC, even in decentralized systems[2][7].

Legal Structuring for Blockchain Projects

Choosing the right legal structure is crucial for blockchain projects. In the U.S., Wyoming’s DAO LLCs provide liability protection while enabling on-chain governance, blending decentralized decision-making with traditional legal enforceability[5]. For token projects, offshore entities like Cayman foundations paired with U.S. C-Corps can reduce SEC exposure while maintaining global market access[2]. Special-purpose vehicles (SPVs) under Regulation S can facilitate token sales to non-U.S. investors without triggering domestic securities registration requirements[5].

Smart contracts also need to align with traditional contract laws. U.S. courts are increasingly recognizing the enforceability of code-based agreements, provided they meet standard contract elements[5]. To ensure smooth execution, projects often rely on formal verification methods, off-chain data oracles, and kill-switches for dispute resolution. Pairing smart contracts with signed, natural-language agreements that clearly define the code’s role as the execution mechanism is another common approach[2]. Best practices include auditing code with tools like Slither, using upgradable proxies for bug fixes, and obtaining legal opinions to formalize intent[5]. For tailored international legal structures, firms like Bestla VC provide support to align on-chain functionality with off-chain regulations[1].

Core Compliance Domains for Enterprise Blockchain

To effectively implement blockchain solutions, enterprises must tackle key compliance areas, including governance, anti-money laundering (AML), and data privacy. These domains are interconnected, requiring a coordinated approach to minimize risks and avoid regulatory penalties [3]. The goal is to establish integrated systems where governance policies guide risk assessments, which then shape AML monitoring and data handling practices.

Governance and Risk Management

Effective governance is essential for managing blockchain-related risks. Enterprises must define clear decision-making processes, such as who oversees smart contract updates, how protocol changes are approved, and which stakeholders have the authority to make compliance decisions [2]. For organizations utilizing decentralized autonomous organizations (DAOs), governance policies should align with traditional corporate standards while leveraging blockchain’s transparency. A strong governance framework should incorporate established risk management methodologies like COSO or ISO 31000. This helps identify threats ranging from technical vulnerabilities (e.g., smart contract bugs or 51% attacks) to operational issues like private key management, regulatory changes, and third-party risks.

Ongoing risk assessment is equally critical. Regular reviews – whether quarterly or more frequent – paired with blockchain’s immutable audit trails can enhance regulatory transparency by providing tamper-proof logs. The 2022 Ronin Bridge hack, which resulted in a $625 million loss, highlights the dangers of inadequate third-party validator monitoring [2]. Enterprises can mitigate such risks by using tools like real-time dashboards to track compliance metrics and conducting scenario testing to anticipate regulatory changes. Platforms recommended by regulators, such as blockchain analytics tools endorsed by the NYDFS, can automate these processes. By integrating these controls with AML and data privacy strategies, enterprises can create a unified compliance framework.

AML, Sanctions, and Financial Crime Compliance

In the U.S., blockchain enterprises must register as Money Services Businesses (MSBs) with FinCEN and adhere to AML requirements under the Bank Secrecy Act [3]. This includes drafting written policies, appointing a Compliance Officer, training staff, conducting independent audits, and implementing risk-based customer monitoring.

Know Your Customer (KYC) processes are crucial, requiring identity verification through government-issued IDs and address proof, screening against OFAC sanctions lists, and applying Enhanced Due Diligence for high-risk customers like politically exposed persons (PEPs) [3]. Advanced techniques like zero-knowledge proofs enable privacy-focused on-chain verification [2]. Meanwhile, Know Your Transaction (KYT) systems use blockchain analytics to flag suspicious activities, such as rapid fund transfers, high-velocity transactions involving privacy coins, or connections to darknet markets. These systems have been shown to reduce false positives by 40–60% in enterprise use cases [2][3].

Real-time screening against OFAC sanctions lists is essential, with wallets and transactions continuously monitored. By 2025, tools like wallet-risk scoring and counterparty analytics have become standard, helping enterprises detect activities like structuring, mixer usage, and transactions linked to sanctioned entities before they are finalized [5]. Enterprises are also required to file Currency Transaction Reports (CTRs) for transactions over $10,000 and Suspicious Activity Reports (SARs) when necessary [3]. These measures must align with broader compliance strategies to ensure thorough coverage.

Data Protection and Privacy

Blockchain’s immutable nature often clashes with modern data protection laws. For instance, the California Consumer Privacy Act (CCPA) grants consumers the right to access, delete, or opt out of the sale of their personal data, with fines reaching up to $7,500 per intentional violation [6]. However, data stored on public blockchains cannot be altered or removed. To address this, enterprises can adopt specific architectural solutions: storing personal data off-chain while using cryptographic hashes to anchor its integrity on-chain, applying pseudonymization techniques like zero-knowledge proofs, or using private/permissioned blockchains with controlled access [2][6].

For example, permissioned networks can store sensitive data off-chain and rely on cryptographic proofs to ensure data integrity, significantly lowering privacy risks [2][6]. Regular audits of data flows, compartmentalized storage practices, and meticulous record-keeping are essential to meet consumer rights requests and maintain alignment with enterprise compliance goals.

sbb-itb-c5fef17

Designing Compliant Blockchain Architectures

When building blockchain systems, regulatory requirements are a key consideration. Decisions about the type of network, identity layers, and logging infrastructure play a crucial role in ensuring compliance with AML (anti-money laundering) laws, tax reporting standards, and customer data protection. These architectural choices can either facilitate or hinder your ability to adapt as regulations evolve. Let’s explore how network designs and protocols can address these regulatory demands.

Network and Protocol Selection

In regulated environments, permissioned platforms like Hyperledger Fabric, Quorum, and Corda are often the go-to choices. These platforms allow for controlled onboarding, fine-grained access control, and enhanced data privacy. For instance:

- Hyperledger Fabric uses private channels to segregate sensitive data while maintaining a verifiable ledger [6].

- Quorum, an enterprise-focused Ethereum variant, supports private transactions, ensuring only authorized participants can view specific details – critical for meeting confidentiality and bank secrecy requirements [6].

- Corda employs point-to-point data sharing, meaning only the involved parties (and regulators, when necessary) access transaction data. This approach minimizes unnecessary exposure while maintaining robust audit trails [6].

Although permissionless networks like Ethereum or Bitcoin can also be used in compliant systems, they often require additional safeguards. These might include KYC-gated wallets, smart-contract whitelists, or off-chain identity verification layers [2]. If your enterprise operates across international borders, it’s vital to work with legal experts to design a structure that aligns with varying regulatory frameworks from the outset [1]. Choosing the right network and protocol can simplify the integration of compliance tools like identity verification and audit mechanisms.

Identity and KYC Integration

To meet FinCEN’s expectations for full AML programs, your blockchain must support robust customer identification and transaction monitoring systems [3]. This begins at the onboarding stage, where off-chain KYC processes verify government IDs, addresses, and conduct OFAC screenings. On-chain, only pseudonymous identifiers and attestations (e.g., “KYC passed” or risk scores) are recorded [2][3].

Integrating Know Your Transaction (KYT) systems adds another layer of security. These systems connect blockchain analytics tools to your ledger, flagging high-risk activities like the use of mixers, transactions involving sanctioned addresses, or attempts to structure transactions in real time [3][5]. Tools like zero-knowledge proofs can strike a balance between privacy and compliance. For example, users can confirm their eligibility – such as age, jurisdiction, or investor status – without revealing their full identity on-chain [2][6].

Additionally, smart contracts can enforce compliance measures automatically. These might include periodic KYC updates, transaction limits for higher-risk profiles, or asset restrictions based on a user’s tier [3]. Together, these identity measures ensure regulatory compliance while maintaining user privacy.

Data Logging and Auditability

Blockchain’s immutability offers a tamper-evident record, but achieving full auditability requires capturing events beyond on-chain transactions. Comprehensive logging should cover the application layer, smart-contract activity, middleware, and infrastructure. These logs should include consistent timestamps, user IDs, transaction hashes, and device details to provide complete traceability [2].

For added security, consider using write-once, append-only log stores or audit blockchains that record hashed, signed log batches. This approach helps detect tampering [2]. By correlating KYC, risk assessments, and approval actions with on-chain transactions, enterprises can create a detailed timeline for auditors [2][3]. Tailoring audit views to meet specific regulatory needs – whether for AML teams, tax authorities, or securities regulators – further streamlines compliance processes. Independent audit access, complete with its own access logging, ensures transparency and trust during external reviews [2].

Combining well-thought-out technical designs with expert legal advice is crucial for staying ahead of regulatory changes. For businesses navigating this complex space, specialized advisors like those at Bestla VC (https://bestla.vc) can provide the insights needed to ensure your blockchain architecture remains compliant and adaptable.

Building a Blockchain Compliance Program

To effectively manage blockchain-related risks, integrate compliance efforts into your existing enterprise risk framework. Start by mapping your blockchain use cases to established risk categories, such as AML, sanctions screening, fraud prevention, operational risk, cybersecurity, and data privacy. Then, update your enterprise risk and control matrix to account for blockchain-specific factors [2][3][5][6]. This method streamlines the process and avoids creating a separate compliance track from scratch. By leveraging a strong foundation, you can design a compliance program that supports operational resilience.

Governance and Policy Development

Your compliance team should align policies with the unique risks posed by blockchain. This includes updating both on-chain and off-chain protocols. Consider appointing a Blockchain Compliance Officer or forming a cross-functional team that includes members from legal, compliance, security, and product departments [2][5]. Ensure this team reports directly to board-level oversight for accountability.

Policies should address critical areas like digital asset custody (key management, multi-party computation, and hardware wallets), on-chain KYC and transaction monitoring, sanctions screening, and smart contract lifecycle management [3][4][5][6]. For example, under FinCEN rules, U.S. crypto businesses classified as Money Services Businesses must register and maintain robust AML programs to avoid penalties [3]. Clearly document thresholds and escalation paths for Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs) as required by the Bank Secrecy Act. Additionally, provide ongoing training to your team on blockchain-specific risks, including privacy coins and mixing services [2][3].

Risk Assessment and Continuous Monitoring

Adopt blockchain analytics tools to monitor transactions, assess wallet risks, and analyze counterparties [3][4][5]. The New York State Department of Financial Services (NYDFS) specifically advises using these tools to strengthen compliance programs, particularly for sanctions, fraud, and AML risk management [4]. Adjust risk scores based on variables like geography, asset type, privacy tools, and high-risk counterparties [3][4][5].

Set up dashboards with key performance indicators (KPIs) to track on-chain risks, such as high-risk counterparties, sanctions hits, and unusual patterns. Review these metrics at least monthly to stay proactive [4][5]. NYDFS also recommends revisiting your risk-management framework whenever there are significant changes to your business model, customer base, or blockchain protocols [4].

Incident Response and Regulator Engagement

Update your incident response plans to handle blockchain-specific events such as key compromises, smart contract exploits, chain forks, and oracle failures [4][5]. Your runbooks should outline steps for freezing funds (where feasible), initiating emergency upgrades or circuit breakers, alerting users, and collaborating with law enforcement. Ensure that your blockchain incident response strategy aligns with existing cybersecurity plans and includes regulatory reporting and privacy compliance measures [6].

Before rolling out major blockchain projects, brief your regulators – whether NYDFS, the Federal Reserve, OCC, SEC, or CFTC – on your use case, risk assessment, and control measures [2][4][5][8]. Participating in regulatory sandboxes and industry working groups can help clarify compliance expectations and reduce uncertainties. For businesses navigating complex legal structures in the web3 space, firms like Bestla VC (https://bestla.vc) provide specialized guidance in creating international legal frameworks and strategic support for digital finance ventures.

Conclusion

Blockchain compliance has become essential for institutional adoption and maintaining market trust. As TrustCloud predicts for 2025, "blockchain and compliance will go hand in hand," highlighting that compliance is now "a necessity for businesses seeking to build trust, protect sensitive data, and mitigate risk." [2] Companies that overlook compliance risk enforcement actions, reputational damage, or even operational shutdowns. On the other hand, those that prioritize governance, risk management, and controls from the beginning can achieve quicker market entry and build stronger partnerships.

A unified compliance strategy is the backbone of blockchain success. Effective adoption requires a blend of legal, technical, and operational measures – ranging from smart contract safeguards and data segregation to robust KYC procedures and sanctions screening. As discussed earlier, cross-functional governance plays a critical role, ensuring that legal, engineering, security, and operations teams share responsibility for decisions and adapt policies as regulations evolve.

The regulatory landscape demands cohesive compliance frameworks. In the U.S., businesses must navigate a patchwork of federal and state regulations, making robust AML programs and advanced blockchain risk controls indispensable. Key compliance measures include written policies, a designated compliance officer, independent audits, employee training, risk-based monitoring, and timely SAR/CTR filings. Tools like wallet-risk scoring and blockchain forensics have become standard. Meanwhile, Brazil’s new VASP regime introduces minimum capital requirements of $2 million to $6.9 million based on activity type, signaling that virtual asset service providers are now held to the same standards as traditional financial institutions. [7]

FAQs

What are the main compliance challenges for enterprises adopting blockchain technology?

Enterprises diving into blockchain technology encounter a range of compliance hurdles. These include managing ever-changing regulations, safeguarding data privacy and security, and tackling risks like fraud and money laundering.

On top of that, companies must handle cross-border regulatory discrepancies, ensure transparency for audits, and establish technical protections to meet rigorous legal and operational requirements. Overcoming these obstacles demands a forward-thinking mindset and a solid grasp of the blockchain landscape.

What steps can businesses take to ensure their blockchain projects comply with global regulations?

To navigate global regulations effectively, businesses need to take initiative by establishing strong legal and technical systems. Working closely with knowledgeable legal experts can help design international frameworks that meet current regulatory requirements. Keeping up with changes in laws and guidelines is equally important to adjust projects when necessary.

Focusing on compliance from the outset not only reduces risks but also strengthens trust among stakeholders and sets the stage for sustained success in blockchain ventures.

What are the key steps for enterprises to establish a strong blockchain compliance program?

To build an effective blockchain compliance program, businesses should focus on a few key steps:

- Understand legal and regulatory requirements: Start by analyzing relevant U.S. laws, such as AML (Anti-Money Laundering), KYC (Know Your Customer), and data privacy regulations, to ensure your operations align with the rules.

- Develop clear policies and procedures: Establish straightforward guidelines that meet compliance standards and are easy for your team to implement.

- Strengthen technical safeguards: Invest in secure systems for monitoring transactions and protecting data to minimize potential risks.

- Train your team: Provide regular training to employees on compliance practices and keep them informed about new regulatory developments.

- Consult with experts: Partner with specialists, like those at Bestla VC, for legal structuring advice and strategic compliance planning.

- Review and adapt regularly: Continuously audit and refine your compliance framework to stay ahead of changes in technology and regulations.

By taking these steps, businesses can create a compliance program that not only meets regulatory requirements but also supports smooth operations.