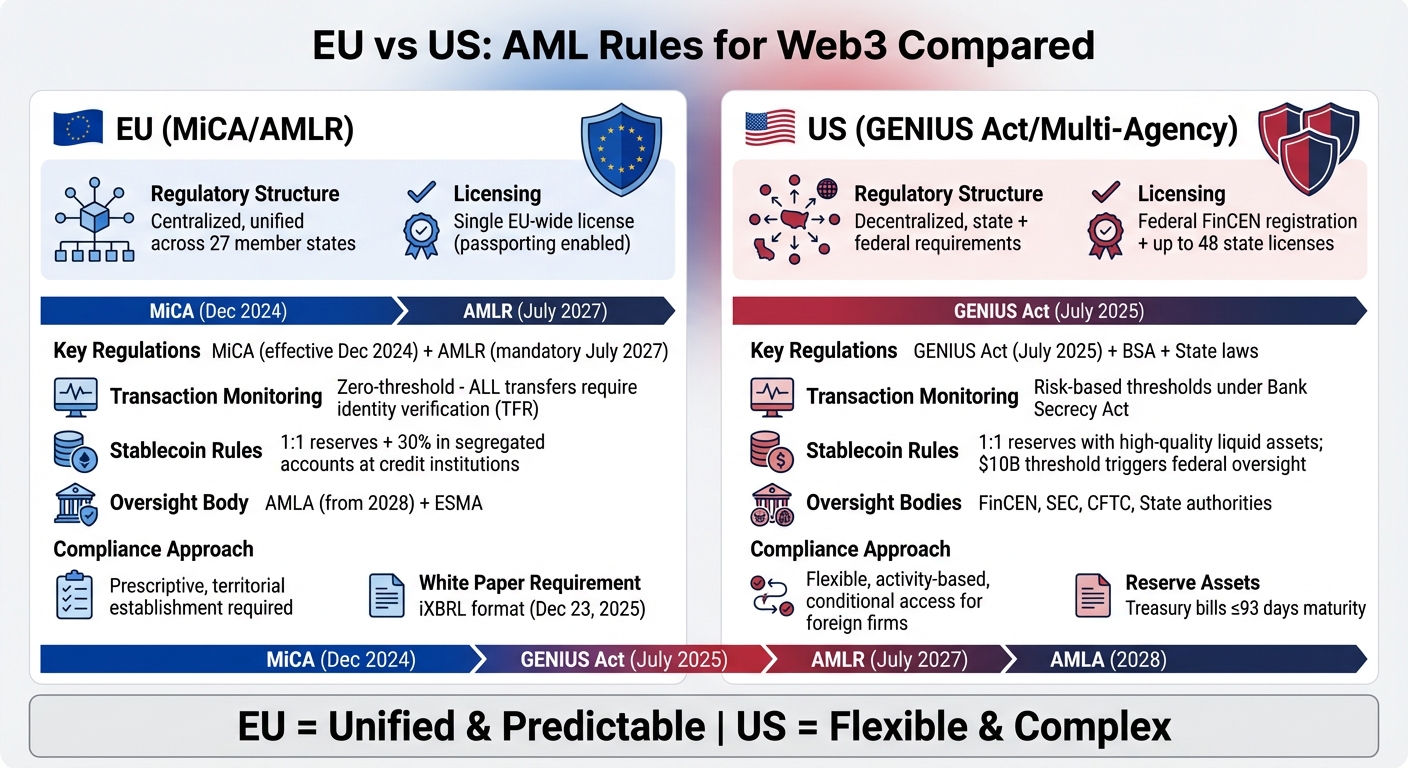

Web3 businesses face different anti-money laundering (AML) rules in the EU and US. The EU uses a centralized approach with unified regulations like MiCA and AMLR, ensuring consistent rules across its 27 member states. The US, however, relies on a decentralized system with multiple agencies like FinCEN and the SEC, offering more flexibility but adding complexity.

Key differences include:

- Licensing: The EU provides a single license valid across all member states, while the US requires separate federal and state registrations.

- Compliance Deadlines: The EU has fixed timelines for rules like MiCA (fully effective by December 2024) and AMLR (mandatory by July 2027). The US implements laws like the GENIUS Act with phased timelines.

- Transaction Monitoring: The EU mandates identity checks for all transactions, regardless of amount, under the Transfer of Funds Regulation (TFR). In the US, thresholds are risk-based under the Bank Secrecy Act (BSA).

- Stablecoin Rules: Both regions require 1:1 reserves, but the EU mandates additional safeguards like segregated accounts for stablecoin issuers.

Quick Comparison

| Feature | EU (MiCA/AMLR) | US (GENIUS Act/Multi-Agency) |

|---|---|---|

| Regulatory Structure | Centralized, unified across 27 states | Decentralized, state and federal requirements |

| Licensing | Single EU-wide license | Federal FinCEN registration + state licenses |

| Transaction Rules | All transfers require identity verification | Risk-based thresholds for identity checks |

| Stablecoin Oversight | Extra reserve safeguards (e.g., segregated accounts) | 1:1 reserves; oversight based on $10B threshold |

Both systems aim to ensure compliance, but businesses must carefully evaluate jurisdiction-specific requirements to avoid penalties and ensure smooth operations.

EU vs US AML Regulations for Web3: Key Differences Comparison

The GENIUS Act Explained: How to Issue and Offer Payment Stablecoins in the United States (Preview)

EU AML Framework: Centralized Regulation

The European Union (EU) has established a unified regulatory system to ensure that the same rules apply across all 27 member states. This centralized approach eliminates the possibility of regulatory arbitrage while maintaining consistent oversight. The aim is straightforward: create a predictable market environment, safeguard consumers, and promote uniformity in regulations[4].

MiCA and AMLR: Core Regulations

The Markets in Crypto-Assets Regulation (MiCA) officially came into effect in June 2023 and will be fully implemented by December 30, 2024[3][4]. MiCA provides a single rulebook for crypto-assets that are not covered under existing financial legislation. By late 2025, over 90 firms had already secured Crypto-Asset Service Provider (CASP) authorization[7].

MiCA enforces strict requirements for stablecoin issuers, including the need to maintain adequate reserves to back the tokens they issue[4]. Additionally, foreign crypto firms must align with EU regulations to gain market access[4]. A key technical requirement under MiCA is that, starting December 23, 2025, all crypto-asset white papers must be prepared in iXBRL (Inline eXtensible Business Reporting Language) format, ensuring they are machine-readable[3].

Complementing MiCA is the Anti-Money Laundering Regulation (AMLR), which introduces stringent anti-money laundering rules for CASPs. These rules will be uniformly applied across all member states starting July 10, 2027[7]. AMLR works closely with the Transfer of Funds Regulation (TFR), which mandates identity verification for every transaction, regardless of the amount[6].

Together, these regulations provide a solid foundation for centralized oversight and regulatory consistency.

Anti-Money Laundering Authority (AMLA) Oversight

To enhance supervision, the EU has introduced centralized monitoring through the Anti-Money Laundering Authority (AMLA). Beginning in 2028, AMLA will oversee high-risk firms, including CASPs[7]. Until then, National Competent Authorities (NCAs) will handle authorizations and report to the European Securities and Markets Authority (ESMA), which maintains a central interim register of authorized CASPs, white papers, and non-compliant entities[3].

ESMA’s Interim MiCA Register, updated weekly (last updated December 23, 2025), acts as a reliable reference point for regulators and the public alike[3]. ESMA also collaborates with NCAs to ensure consistent authorization standards across member states, ensuring that a company applying in France, Germany, or Malta faces the same regulatory expectations[3].

Compliance Costs and Deadlines

While the EU’s regulatory framework offers clarity, it comes with significant operational demands. Businesses operating in the Web3 space must allocate resources for compliance teams, blockchain monitoring systems, and TFR verification tools[6]. Additionally, mandatory JSON schemas for order books and trade records are required to facilitate smooth data exchange[3].

Entities operating before December 30, 2024, benefit from a transitional "grandfather clause" until July 1, 2026, or until they secure MiCA authorization[3]. However, starting the authorization process early is strongly recommended to avoid disruptions in service[3].

| Requirement | Date | Description |

|---|---|---|

| iXBRL White Papers | December 23, 2025 | White papers must use the MiCA XBRL Taxonomy 2025 for machine-readable formatting[3] |

| JSON Data Standards | Within 6 months of November 28, 2025 | Standardized schemas for orders and trades expected by NCAs[3] |

| Grandfathering End | July 1, 2026 | Deadline for entities to transition from old national laws to MiCA compliance[3] |

| AMLR Application | July 10, 2027 | AML requirements become mandatory across all member states[7] |

| AMLA Supervision | 2028 | Centralized oversight of high-risk CASPs begins[7] |

Although compliance entails higher operational costs – covering licensing, reserve requirements, and internal security measures[5][6] – the EU’s structured approach is drawing traditional financial institutions into the Web3 space[7].

US AML Framework: Multi-Agency System

Unlike the EU’s centralized approach, the United States employs a decentralized system, distributing regulatory authority across multiple agencies. Key players in this system include the SEC, CFTC, FinCEN, and state authorities, each with distinct roles in overseeing Web3 activities. The Digital Asset Market Clarity Act of 2025 assigns the CFTC oversight of digital commodity spot markets, while the SEC handles digital asset securities[11].

Regulatory Bodies and Their Roles

FinCEN plays a central role in enforcing AML compliance under the Bank Secrecy Act (BSA). It categorizes crypto exchanges and administrators as Money Services Businesses (MSBs) and money transmitters[8]. This classification comes with strict requirements, including registration with FinCEN and the implementation of a four-part AML program. These programs must include documented policies, a compliance officer, employee training, and independent audits[8].

"We will not allow cryptocurrency to become the equivalent of secret numbered accounts. We will allow for proper use, but we will not tolerate the continued use for illicit activities." – Steven Mnuchin, U.S. Treasury Secretary[8]

In a landmark case from April 2019, FinCEN issued its first penalty against a peer-to-peer cryptocurrency exchange, fining an individual $35,000. The person had conducted millions of dollars in Bitcoin transactions over two years without registering as an MSB, failing to adopt an AML program, and neglecting to file required reports on large or suspicious transactions[8].

State authorities also play a significant role, particularly in licensing and enforcing the Travel Rule. This rule requires Virtual Asset Service Providers to securely transmit originator and beneficiary information for transactions. Additionally, customer due diligence (CDD) is mandatory for occasional transactions exceeding $1,000[8].

Federal legislation continues to refine the regulatory framework for digital assets.

The GENIUS Act: New Federal Legislation

The GENIUS Act of 2025, enacted on July 18, 2025, introduces clear guidelines for payment stablecoins[9]. It mandates that Permitted Payment Stablecoin Issuers (PPSIs) maintain 1:1 reserves with high-quality liquid assets and implement mechanisms for disabling and destroying digital assets[11]. Under the BSA, these issuers are classified as "financial institutions", requiring them to establish AML programs, file suspicious activity reports (SARs), and implement customer identification protocols[11].

"Advancement of this bill to President Trump’s desk marks a historic milestone for crypto entrepreneurs, financial market participants, and everyday Americans." – Paul Atkins, Chairman, Securities and Exchange Commission[9]

PPSIs operating under state supervision must limit their issuance to less than $10 billion in stablecoins. Exceeding this threshold triggers federal oversight or requires a special waiver[11]. Reserves must consist of high-quality liquid assets, such as Treasury bills with maturities of 93 days or less[11]. Analysts suggest this legislation could boost the market value of the stablecoin sector by over 342%[10].

The GENIUS Act is set to take effect 18 months after its signing date or 120 days following the issuance of final regulations, whichever comes first[11].

These measures aim to balance flexibility with stringent compliance demands.

Flexibility and Compliance Challenges

The US regulatory framework provides tailored pathways for trading and custody but comes with intricate dual state-federal requirements[11]. This decentralized approach contrasts with the EU’s single-rulebook system, which applies uniformly across member states.

Web3 businesses must navigate a maze of regulators depending on their digital asset’s classification. For instance, the SEC oversees securities, the CFTC handles commodities, and FinCEN enforces AML obligations[11]. Companies operating under state licenses must carefully monitor their issuance volumes, as surpassing $10 billion necessitates federal oversight[11]. Additionally, the requirement to implement technical controls for disabling and destroying digital assets adds operational challenges, even for foreign issuers listed on US secondary markets[11].

The crypto industry invested over $100 million in Congressional races in 2024, reflecting the high stakes of shaping these regulatory frameworks[9]. While the post-2024 election climate has leaned more favorably toward Web3 technologies[11], businesses must still grapple with dual compliance structures and jurisdictional uncertainties. These complexities are pivotal in shaping decisions around market entry and operational strategies.

EU vs US: AML Requirements Compared

The European Union (EU) operates under a unified licensing system through MiCA, whereas the United States (US) employs a dual framework that combines state and federal regulations. The EU’s method is more structured, requiring businesses to provide auditable proof of compliance before they can begin operations. On the other hand, the US framework leans toward flexibility, focusing on the nature of activities rather than rigid categories of operation[13]. Below, we dive into how licensing, reporting, and cybersecurity differ between the two systems.

The EU applies a "territorial establishment model", which requires Crypto-Asset Service Providers to maintain a registered office, effective management, and at least one director residing within the EU[13]. Meanwhile, the US GENIUS Act introduces a "conditional access model" for stablecoin issuers. This could allow foreign entities to enter the US market without a local subsidiary, provided their home regulations meet certain comparability standards[13].

"The US model privileges conditional openness based on functional equivalence… The EU model insists on territorial establishment to ensure direct supervisory control." – Bird & Bird[13]

Licensing Requirements

The licensing requirements in the EU and US reveal stark differences in how each region balances market access with oversight. In the EU, MiCA allows a company authorized in one member state to operate across all 27 member countries. In contrast, the US requires companies to register federally with FinCEN and potentially secure money transmitter licenses in up to 48 states, each with unique requirements[12].

This difference highlights the EU’s focus on local establishment versus the US’s approach of functional oversight.

| Feature | EU (MiCA / AMLR) | US (GENIUS Act / Multi-Agency) |

|---|---|---|

| Licensing Structure | Unified system with passporting across 27 states | Dual system (State and Federal requirements) |

| Local Presence | Mandatory (Registered office and management in the EU) | Conditional (Reciprocity for foreign firms possible) |

| Stablecoin Issuer Types | Credit Institutions or E-money Institutions | Banks or "Qualified" State/Federal non-bank issuers |

| Regulatory Approach | Prescriptive and detailed | Flexible and activity-based |

| Supervisory Graduation | Based on "significance" (EBA oversight) | Based on $10 billion circulation threshold |

While the US system offers customized pathways for different business models, navigating jurisdictional boundaries can be challenging. On the other hand, the EU’s upfront compliance requirements may discourage smaller international players from entering the market.

Reporting and Due Diligence

The EU and US also differ significantly in how they handle transaction monitoring and identity verification. Starting December 2024, the EU’s Transfer of Funds Regulation (TFR) will require Crypto-Asset Service Providers to collect and share originator and beneficiary data for every transfer, regardless of the amount involved[15]. This "zero-threshold" approach contrasts with the US, where FinCEN allows firms to set thresholds based on their own risk assessments under the Bank Secrecy Act (BSA)[14].

The EU is transitioning from fragmented national rules to a unified system, with the Anti-Money Laundering Authority (AMLA) in Frankfurt coordinating efforts across member states[15]. In the US, FinCEN oversees federal compliance, while state authorities enforce additional rules. This can lead to variations in implementation; for instance, Germany often requires video-based KYC verification, whereas other EU countries allow fully automated biometric methods[2].

| Feature | European Union (EU) | United States (US) |

|---|---|---|

| Primary Legislation | MiCA, TFR, and AMLR | Bank Secrecy Act (BSA) |

| Regulatory Body | AMLA (Central) & National FIUs | FinCEN (Treasury Department) |

| Transaction Monitoring | TFR mandates data sharing for all transfers | Risk-based monitoring under BSA AML programs |

| Identity Verification | Governed by eIDAS and AMLD, with varying methods (e.g., video-based KYC in Germany) | KYC as part of MSB registration and AML programs |

| Reporting Requirement | Suspicious Transaction Reports (STRs) to national FIUs | Suspicious Activity Reports (SARs) to FinCEN |

In the US, most Web3 entities – such as peer-to-peer exchangers, hosted wallet providers, and crypto kiosks – are classified as money transmitters under the BSA. This classification requires them to implement formal AML programs that include documented policies, designated compliance officers, employee training, and independent audits[14]. In contrast, the EU’s framework emphasizes traceability, with the TFR placing extensive obligations on Crypto-Asset Service Providers to ensure transparency in transfers[15].

Asset Custody and Cybersecurity Rules

Asset custody and cybersecurity regulations further distinguish the EU and US approaches. Both frameworks require 1:1 stablecoin reserve backing[12]. However, the EU takes it a step further by mandating that stablecoin issuers deposit at least 30% of the funds received for E-money tokens into segregated accounts held at credit institutions[13]. This requirement adds an extra layer of consumer protection that is absent in US rules.

The EU also obligates companies to publish detailed white papers outlining risks to consumers, including disclosures about blockchain energy use and environmental impact[4]. This level of environmental reporting has no federal counterpart in the US, where the focus remains on financial integrity and AML compliance. Additionally, EU firms must adhere to the Digital Operational Resilience Act (DORA), which enforces strict ICT risk management and incident reporting standards that are not mirrored in US regulations[13].

sbb-itb-c5fef17

Compliance Strategies for Web3 Businesses

Budgeting for Compliance

Meeting AML (Anti-Money Laundering) requirements in the EU and US isn’t just about ticking boxes – it requires careful financial planning. Businesses need to allocate budgets for compliance officers, employee training, regular audits, and advanced monitoring systems. Automation plays a crucial role here. AI-driven tools can simplify processes like identity verification, transaction monitoring, and sanctions screening. These technologies not only cut down on costs but also minimize errors, making them a practical choice for businesses navigating complex compliance landscapes[2].

Choosing the Right Jurisdiction

Compliance costs and strategies often shape where businesses decide to operate. The choice of jurisdiction depends on factors like the business model and target market. For instance, the EU offers a unified licensing framework under MiCA (Markets in Crypto-Assets Regulation). With this system, businesses authorized in one EU member state can operate across all 27 countries – a concept known as passporting. However, this convenience comes with strict upfront compliance requirements.

On the other hand, the US offers more flexibility, but it comes with a maze of regulatory layers. Businesses must register with FinCEN (Financial Crimes Enforcement Network) and may also need money transmitter licenses from various states. Each state has its own set of rules, adding complexity to the process. For DeFi (decentralized finance) projects, the focus is shifting toward risk management rather than traditional regulatory models. Yaya Fanusie, Global Head of Policy at Aleo, highlights this shift:

"I would describe developers’ obligations more as ‘risk management,’ focusing on what issues they might encounter"[16].

Since DeFi operates on a global scale, meeting every jurisdiction’s specific requirements is nearly impossible. This forces businesses to prioritize markets based on their compliance capabilities and strategic objectives. Maha El Dimachki, Head of BIS Innovation Hub‘s Singapore Centre, explains that regulators are increasingly exploring:

"outcome-based policymaking, with regulators looking to prevent malicious activity [is] the goal of how they could approach rules around DeFi"[16].

How Bestla VC Supports Compliance

Navigating the intricate maze of AML requirements requires a mix of legal know-how and technical expertise. Bestla VC steps in to provide Web3 ventures with tailored legal consultancy services, helping them set up optimal legal structures for their operations. With expertise in digital finance and a deep understanding of both EU and US regulatory landscapes, Bestla VC assists businesses in creating compliance frameworks that address multiple jurisdictions simultaneously.

But their support doesn’t stop at legal frameworks. Bestla VC also advises early-stage projects on integrating compliance into their technical design from the very beginning. This proactive approach aligns with the evolving regulatory mindset. As Lee Schneider, General Counsel at Ava Labs, puts it:

"Neither developers nor regulators want users to lose their money… In that sense, both parties here are aligned in their goals for DeFi"[16].

Future of AML Regulation in Web3

Global Standards Alignment

By late 2025, the regulatory paths of the EU and the US in Web3 are diverging noticeably. The US has leaned into deregulation and strategic leadership, highlighted by the Treasury Department’s decision to lift sanctions on Tornado Cash in March 2025[5]. On the other hand, the EU is doubling down on compliance, with its MiCA and AMLR frameworks set to take full effect by July 10, 2027[7].

Interestingly, the stablecoin sector is seeing some alignment. The US GENIUS Act has become a key reference point internationally, influencing policies in the EU, UK, and Hong Kong[7]. For example, Hong Kong passed its Stablecoin Ordinance in August 2025, with the first licenses expected by early 2026[7]. Meanwhile, the Financial Action Task Force (FATF) remains a driving force for global regulatory consistency, with its Q1 2026 analysis on stablecoins poised to shape international expectations[7].

However, challenges persist. European officials worry that the US’s more relaxed approach could lead to asset migration across the Atlantic, potentially undermining the EU’s push for greater strategic autonomy[5]. This philosophical divide is stark: the US prioritizes flexibility and innovation, while the EU focuses on structure and protection[5]. These contrasting approaches are setting the stage for how regulation will tackle DeFi and other emerging technologies.

Regulating DeFi and New Technologies

Decentralized finance (DeFi) presents a unique challenge for regulators. Its borderless and permissionless nature doesn’t fit neatly into traditional compliance models. As a result, regulators are shifting toward outcome-based policies to address DeFi’s complexities[16].

Developers are being urged to embed compliance mechanisms into their platforms while still maintaining decentralization[16]. One major hurdle is determining liability. For instance, should developers be held accountable when bad actors create their own front-ends to exploit open-source protocols?[16]

The EU is taking a firm stance with its MiCA framework, which prevents platforms from targeting EU users unless they comply with local laws[4]. This essentially forces global platforms to adopt EU standards if they want market access. Meanwhile, Russia is also stepping into the regulatory arena. In December 2025, its central bank unveiled a framework to legalize cryptocurrency trading through regulated platforms. This includes mandatory tax reporting for cross-border transactions and limits for non-qualified investors, set to roll out by 2027[16]. These evolving regulations aim not only to address DeFi’s unique challenges but also to strengthen anti-money laundering (AML) efforts across jurisdictions.

Growth Opportunities from Regulation

Amid these regulatory changes, new opportunities are emerging for institutional investors in the Web3 space. In December 2025, the SEC issued a no-action letter to the Depository Trust Company (DTC), paving the way for securities tokenization schemes to integrate with mainstream financial infrastructure. This move has encouraged traditional financial institutions to become more involved in custody, trading, and stablecoin issuance[7].

The numbers tell the story. By December 2025, tokenized money market funds holding U.S. Treasuries surpassed $8 billion in assets under management. Tokenized commodities like gold reached $3.5 billion, and over 90 firms were authorized as Crypto-Asset Service Providers (CASPs) in the EU under MiCA[7].

"Beyond preventing money laundering and financing of terrorism, we also need to put in place effective digital assets regulations worldwide to protect the people, the users of this technology."

- Attorney Claudia M. Hernández[4]

As regulatory frameworks mature, they are providing the predictability that institutional investors need to confidently engage with the Web3 ecosystem.

Conclusion

By 2025, the regulatory landscape for Web3 has taken two distinctly different paths. In the European Union, frameworks like MiCA and AMLR have introduced a centralized, unified approach. This provides consistent rules across 27 countries, ensuring market predictability but at the cost of high compliance expenses and strict consumer protections. Meanwhile, in the United States, regulation remains fragmented, with multiple agencies involved. However, there’s a shift underway – legislation like the GENIUS Act reflects an effort to support innovation while maintaining strong AML enforcement measures.

Despite these differences, both regions share common regulatory expectations. Businesses must implement robust KYC/AML programs, maintain proper stablecoin reserves, conduct sanctions screenings, and report suspicious activities. These shared requirements underline the need for strategic compliance planning, especially as businesses face varying regulatory demands.

For Web3 ventures, compliance isn’t just about understanding the rules – it’s about tackling real-world challenges. This includes budgeting for compliance costs, choosing the right jurisdiction, and meeting critical deadlines, such as the US digital asset working group’s proposal due on July 22, 2025[17]. Companies must also be vigilant to avoid criminal liabilities under laws like 18 U.S.C. §1960[1].

As outlined earlier, the contrasting regulatory approaches in the EU and US call for tailored compliance strategies. Navigating these complexities requires specialized legal support. Bestla VC offers precisely this kind of expertise, helping businesses build compliant frameworks and manage cross-border regulatory challenges. By partnering with experts, Web3 ventures can focus on innovation without compromising on compliance, striking the necessary balance between consumer protection and the dynamic world of digital assets.

FAQs

What are the key differences between AML regulations for Web3 businesses in the EU and the US?

The European Union has introduced a unified set of rules for anti-money laundering (AML) in the crypto space through the Markets in Crypto-Assets Regulation (MiCA). These rules will be fully enforced by December 30, 2024, with stablecoin-specific regulations coming into effect earlier, on June 30, 2024. MiCA, combined with updates to the EU’s AML and counter-terrorism financing (CFT) framework, establishes standardized requirements for crypto-asset service providers (CASPs) across all EU member states. This ensures consistent compliance expectations throughout the region.

On the other hand, the United States does not have a dedicated AML framework tailored specifically for Web3. Instead, crypto businesses are regulated under the Bank Secrecy Act (BSA) and guided by FinCEN’s regulations, which classify them as Money Services Businesses (MSBs). As a result, these businesses must adhere to existing requirements for customer due diligence, reporting, and record-keeping, similar to traditional financial institutions. However, enforcement in the US varies by state and is based on pre-existing laws rather than a cohesive national framework.

In summary, the EU provides a streamlined and unified regulatory approach with clear timelines, whereas the US takes a more fragmented and state-driven approach to regulating Web3 businesses.

What are the key differences in licensing requirements for Web3 companies in the EU and the US?

In the EU, Web3 companies operate under the Markets in Crypto-Assets Regulation (MiCA), which establishes a standardized licensing framework across all member states. This means businesses like exchanges, custodians, and stablecoin issuers must secure a license from the national authority in their home country. MiCA also sets out requirements for anti-money laundering (AML), capital adequacy, and specific rules for stablecoins, with full enforcement scheduled for December 30, 2024.

In contrast, the US lacks a single federal license for Web3 activities. Companies are required to register as a Money Services Business (MSB) with FinCEN under the Bank Secrecy Act and adhere to AML regulations. On top of that, most states mandate separate money transmitter licenses, and firms handling tokens resembling securities may need to register with the SEC or as broker-dealers. This creates a patchwork of state-level regulations, making compliance more complex.

The EU’s unified framework offers a stark contrast to the US’s fragmented system, demanding distinct compliance strategies for each region. Bestla VC assists Web3 projects in navigating these intricate regulatory landscapes.

What are the key compliance challenges for Web3 businesses in the U.S. compared to the EU?

Web3 businesses operating in the United States face a complicated regulatory environment, shaped by overlapping federal and state requirements. Companies must adhere to rules from agencies like FinCEN, the SEC, and the CFTC, while also meeting state-specific regulations such as New York’s BitLicense. This patchwork of regulations makes compliance both challenging and expensive. On top of that, businesses must contend with stringent KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, as well as tax rules that treat every crypto transaction as a taxable event, adding to the operational burden.

In comparison, the European Union provides a more coordinated regulatory framework through the Markets in Crypto-Assets Regulation (MiCA). MiCA harmonizes AML and Counter-Terrorism Financing (CTF) rules across all member states, making compliance more straightforward for crypto-asset service providers. Although the EU is phasing in MiCA’s provisions through 2026, its unified approach addresses much of the regulatory fragmentation that U.S. firms face.

In short, while U.S. companies grapple with a more fragmented and complex system, businesses in the EU enjoy greater regulatory consistency, even as they adapt to the ongoing implementation of MiCA.