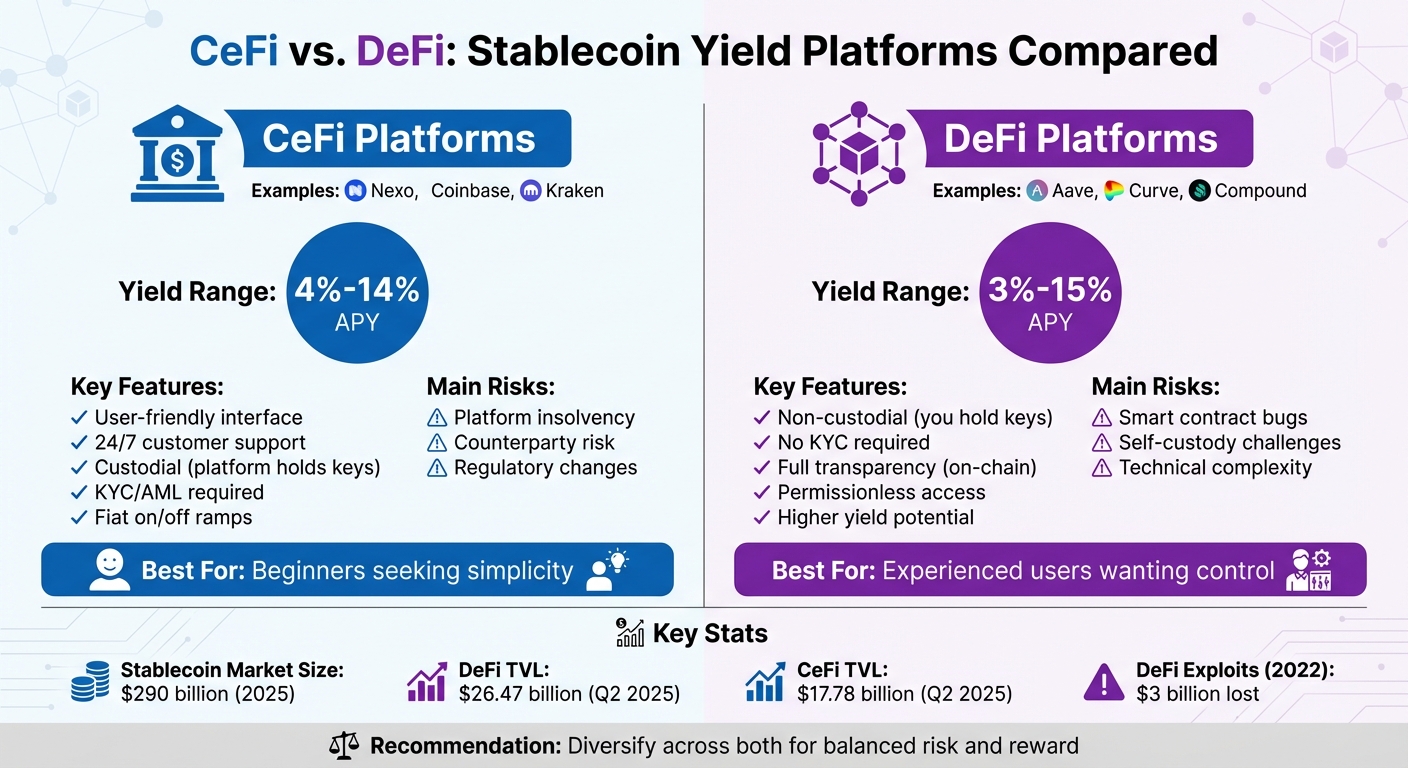

Stablecoin yields have become a popular choice for crypto investors seeking steady returns. By 2025, stablecoins like USDT, USDC, and DAI dominate the $290 billion market. Investors can earn yields ranging from 2% to 15% APY by using either centralized finance (CeFi) or decentralized finance (DeFi) platforms. Here’s the difference:

- CeFi Platforms: User-friendly, custodial services (e.g., Nexo, Coinbase). Yields: 4%-14% APY. Risks include platform insolvency and regulatory changes.

- DeFi Platforms: Non-custodial, smart contract-based (e.g., Aave, Curve). Yields: 3%-15% APY. Risks include smart contract vulnerabilities and self-custody challenges.

Quick Comparison:

| Feature | CeFi (Nexo, Coinbase) | DeFi (Aave, Curve) |

|---|---|---|

| Yield Potential | 4%-14% APY | 3%-15% APY |

| Ease of Use | Simple | Requires technical knowledge |

| Custody | Custodial | Non-custodial |

| Risks | Platform insolvency | Smart contract bugs |

| KYC/AML | Mandatory | None |

Key Takeaway: CeFi is ideal for beginners seeking simplicity, while DeFi offers higher returns for experienced users comfortable with managing private keys. Diversify across both for balanced risk and reward.

CeFi vs DeFi Stablecoin Yield Platforms Comparison Chart

CeFi Stablecoin Yield Platforms

How CeFi Platforms Work

CeFi platforms operate much like traditional banks, but for cryptocurrencies. When you deposit stablecoins, these platforms take custody of your funds – meaning they hold the private keys, not you. By handing over control, you allow the platform to manage and deploy your assets. Typically, they lend out your deposits or use them in various yield-generating strategies.

The process is straightforward: sign up, complete KYC (Know Your Customer) and AML (Anti-Money Laundering) verifications, deposit your stablecoins like USDT or USDC, and start earning. The platform handles the heavy lifting – managing your funds to earn returns – while you benefit from predictable interest, dedicated customer support, and easy fiat on/off ramps.

This custodial approach is particularly appealing for beginners who want a hassle-free experience without worrying about managing wallets or navigating blockchain transactions. As Coinbase explains:

"CeFi, short for centralized finance, offers some of the yield benefits of DeFi with some of the ease of use and security of traditional financial-services products" [8].

This simplicity is why CeFi platforms are often seen as a bridge between traditional finance and the decentralized world, making it easier to understand how yields are generated.

Expected Returns on CeFi Platforms

Yields on CeFi platforms for stablecoins generally range between 4% and 14% APY, depending on the platform and specific conditions like holding native tokens or agreeing to lock-up periods.

Here’s a quick comparison of some leading platforms:

| Platform | Asset | Base APY | Max APY | Requirements for Max Rate |

|---|---|---|---|---|

| Nexo | USDT | 9.00% | 16.00% | 3-month lock; >10% NEXO tokens; interest paid in NEXO [9] |

| Nexo | USDC/DAI | 8.00% | 14.00% | 3-month lock; >10% NEXO tokens; interest paid in NEXO [9] |

| Ledn | USDT/USDC | 6.50% | 8.50% | Higher rate applies to balances over $100,000 [9] |

| Coinbase | USDC | 4.00% | 4.10% | US-based customers; principal guarantee offered [10][8] |

| Phemex | USDT/USDC | 5.00% | 10.00% | Flexible savings; no lock-up [1] |

For example, Nexo, which has processed over $80 billion in transactions since its launch in 2018, offers some of the highest yields. However, unlocking these rates requires holding their native NEXO token. On the other hand, Coinbase provides a more conservative 4% APY on USDC, with the added benefit of a principal guarantee for eligible U.S. users – a rare feature in the crypto industry.

CeFi Platform Risks

Despite the attractive yields, CeFi platforms come with certain risks. The most significant is counterparty risk. Since the platform has full control over your funds, your returns – and your capital – are tied to the platform’s financial health. If the platform mismanages assets or faces bankruptcy, you could lose your deposits. Unlike traditional banks, crypto deposits on CeFi platforms are not protected by insurance.

Regulatory risks are another factor. For instance, the EU’s MiCA regulation prohibits stablecoin issuers from offering direct interest payments, requiring platforms to rethink their "Earn" programs. As Regular.eu notes:

"The idea of ‘earning interest by simply holding a stablecoin’ is now prohibited under MiCA for all regulated tokens" [7].

Liquidity risk is also a concern. Without government-backed safety nets, CeFi platforms can face "bank runs", where a surge in withdrawals freezes funds. The IMF highlights this vulnerability:

"The challenge is not simply the loss of deposits; it is the speed at which they can vanish. If an institution holding large stablecoin reserves experiences financial distress, issuers could withdraw billions in seconds" [11].

To mitigate these risks, reputable platforms implement measures like cold storage for most assets, multi-factor authentication, and publishing Proof of Reserves or independent audits. For example, Ledn regularly releases open-book reports to confirm its assets are fully backed. However, it’s always wise to independently verify these safeguards before depositing your funds.

DeFi Stablecoin Yield Platforms

How DeFi Platforms Work

DeFi platforms operate without intermediaries. Instead of entrusting your funds to a centralized entity, you maintain full control of your private keys and assets. Transactions are executed through smart contracts on public blockchains, eliminating the need for middlemen or mandatory KYC processes.

When you deposit stablecoins into a DeFi protocol, you’re directly engaging with transparent, open-source code. Unlike centralized finance (CeFi), where custodial risk is a concern, DeFi places the responsibility squarely on the user. Funds are typically directed into over-collateralized lending markets. For instance, a borrower might deposit $15,000 worth of ETH to secure a $10,000 USDC loan. If the value of the collateral drops too much, the smart contract automatically liquidates the position to protect lenders.

Another way to earn yield is by providing liquidity to decentralized exchanges like Curve. Your stablecoins enable trades between tokens such as USDT, USDC, and DAI. The process is entirely permissionless – anyone with a crypto wallet can participate, and all transactions are recorded on-chain, ensuring real-time visibility.

As Christopher Rosa, Vice President at Galaxy, puts it:

"DeFi yield was largely driven by straightforward mechanisms such as lending and liquidity provision. The ecosystem has since evolved into a rich landscape of complex and highly diverse strategies" [13].

This level of transparency and control makes DeFi particularly attractive to seasoned users who prioritize auditability over convenience.

Expected Returns on DeFi Platforms

Now that we’ve covered how DeFi platforms work, let’s look at the potential returns. Yields in DeFi generally range from 3% to 15% APY, depending on market conditions. While advanced strategies or temporary incentives can push returns higher, most sustainable yields stay within this range.

Take Aave, for example – a well-established lending protocol managing over $28.47 billion in total value locked as of 2025 [5]. On Aave, USDC lenders can earn mid-single-digit yields. Similarly, Curve Finance offers yield opportunities through stablecoin swap pools, often sweetened with rewards in the form of protocol tokens like CRV.

Ethena Finance employs a delta-neutral strategy to generate yield. Its sUSDe token combines staked ETH with short perpetual futures positions, earning both staking rewards and funding rate payments. After an initial phase of higher returns, sUSDe yields have stabilized between 7% and 12% [13].

For those looking for a more traditional finance-like approach on-chain, MakerDAO’s sDAI provides an option. Users can deposit DAI into the Dai Savings Rate (DSR) contract, where the sDAI token automatically accrues interest. This interest comes from MakerDAO’s stability fees and investments in assets like U.S. Treasuries [12][4].

DeFi Platform Risks

While DeFi offers exciting opportunities, it’s not without risks. The biggest concern is smart contract vulnerabilities. Even extensively audited code can have bugs or be exploited, and since there’s no centralized safety net or insurance fund, any exploited funds are usually lost.

Self-custody is another challenge. Losing your private keys, falling for phishing scams, or interacting with malicious contracts can result in irreversible losses.

Market volatility poses additional risks. During times of high demand or mass withdrawals, lending platforms may experience high utilization rates, which could temporarily delay or freeze withdrawals. DeFi protocols also rely on oracles to price collateral. If these oracles are manipulated or provide inaccurate data, it could lead to unnecessary liquidations or under-collateralized loans.

On Ethereum, network fees can be a hurdle. During peak times, fees can range from $10 to $50, cutting into returns on smaller deposits. Layer 2 solutions like Arbitrum and Optimism help reduce fees, but they come with their own risks, such as potential issues with bridging and liquidity.

To manage these risks effectively, consider using protocols with a proven track record and multiple independent security audits. Diversifying across platforms, monitoring key metrics like utilization ratios, verifying smart contract addresses, and using hardware wallets for secure storage are all smart practices. These steps highlight the importance of careful risk management in navigating the stablecoin yield space.

Stablecoin Yield Farming Opportunities: DeFi vs CeFi Platforms – Stablecoin Summit 2023

sbb-itb-c5fef17

CeFi vs. DeFi: Side-by-Side Comparison

This section highlights the key differences between CeFi and DeFi stablecoin yield platforms by examining their strengths, weaknesses, and risk profiles.

Advantages and Disadvantages

CeFi platforms shine when it comes to ease of use. They operate much like traditional online banking, offering straightforward account setup, full customer support, and smooth fiat transfers. This makes them a great starting point for newcomers. However, the trade-off is trust – you rely on a third party to manage your funds. If the platform faces insolvency or freezes withdrawals, your funds could be inaccessible. Additionally, CeFi lacks transparency, as users have no visibility into how their funds are being utilized.

DeFi, on the other hand, emphasizes user control. You keep complete ownership of your private keys and can track every transaction on the blockchain. There’s no need for intermediaries or KYC processes. The downside? It requires a solid understanding of wallet security, smart contracts, and gas fees. Mistakes like losing your seed phrase or interacting with a malicious contract can result in permanent loss, with no customer support to help.

Yield potential differs as well. DeFi often offers higher returns, as seen in the comparison table below. By Q2 2025, DeFi platforms had a total value locked (TVL) of $26.47 billion, surpassing CeFi’s $17.78 billion [3].

The risks also diverge. CeFi carries counterparty risk, meaning the platform could misuse funds or go bankrupt. In contrast, DeFi’s main concern is smart contract vulnerabilities. Even well-audited contracts can contain exploitable flaws, with over $3 billion lost to DeFi exploits in 2022 alone [14]. Despite this, CeFi remains dominant in institutional lending, accounting for 60% to 70% of crypto-related loans [3].

These differences highlight how custody, transparency, and technical expertise shape the outcomes of stablecoin yield strategies. The table below provides a quick comparison of these factors.

Comparison Table

| Feature | CeFi (e.g., Nexo, Kraken) | DeFi (e.g., Aave, Compound) |

|---|---|---|

| Yield Potential | Moderate (4%–8% avg) [1] | High (6%–15% avg) [1] |

| Ease of Use | Simple, user-friendly [3] | Technical, requires Web3 knowledge [3] |

| Custody | Custodial (Platform holds keys) [3] | Non-custodial (User holds keys) [3] |

| Risk Exposure | Platform insolvency, counterparty risk [3] | Smart contract bugs, hacks [3] |

| Liquidity | May have lock-up periods or withdrawal delays [2] | Generally instant/flexible (unless in a "bank run") [2] |

| KYC/AML | Mandatory [2] | None (Permissionless) [2] |

| Transparency | Opaque (Off-chain) | High (On-chain) |

| Customer Support | 24/7 professional support [14] | None; community-led or self-taught [14] |

Risks and How to Manage Them

Shared Risks Across Platforms

Both DeFi and CeFi platforms, despite their differences, share some overlapping vulnerabilities that users should understand.

One major risk is stablecoin depegging, where a stablecoin’s value strays from its intended $1 target. A stark example occurred in March 2023 when USDC dropped to $0.87 after the collapse of Silicon Valley Bank. Although Circle quickly reassured users about the safety of its reserves and restored the peg, the incident highlighted how fragile trust can be in such scenarios [6].

Another shared risk is liquidity crunches. For instance, in July 2025, Ethereum’s validator exit queue ballooned to over 600,000 ETH – equivalent to about $2.3 billion – causing extended delays for unstaking [13]. Both ecosystems are vulnerable to such liquidity bottlenecks, particularly during periods of market stress.

Lastly, regulatory changes can disrupt operations overnight. The GENIUS Act, signed in July 2025, imposed restrictions on how payment stablecoin issuers distribute interest, prompting some platforms to switch to points-based rewards rather than cash payouts [13]. Similarly, Europe’s MiCA framework prohibits direct interest payments on stablecoins, forcing users to rely on external lending protocols [7]. Such shifts can significantly alter payout structures and user strategies.

Recognizing these risks is the first step toward managing them effectively.

Risk Reduction Strategies

To navigate these challenges, consider the following strategies:

- Diversify across platforms and stablecoin types. Avoid concentrating all your funds in one protocol or issuer. A "core-satellite" strategy works well: allocate 60% of your capital to established platforms like Kraken or Aave, and the remaining 40% to higher-risk, higher-yield options [6]. Additionally, stagger your deposits into fixed-term platforms like Nexo on a weekly or monthly basis. This approach ensures regular liquidity while optimizing returns [6].

- Assess platform security before depositing funds. In DeFi, focus on protocols audited by reputable firms such as OpenZeppelin, Trail of Bits, or Certik [6]. For CeFi, review Proof of Reserves attestations and investigate how the platform handles user funds. Keep an eye on Total Value Locked (TVL) and trading volumes – sudden declines could indicate trouble [2]. Maintain some liquidity in easily accessible assets to handle market volatility [7]. For added security, use hardware wallets like Ledger for DeFi transactions and enable address whitelisting on CeFi platforms to ensure withdrawals only go to pre-approved addresses [6].

Here’s a quick breakdown of common risks, their warning signs, and best practices:

| Risk Type | Signs | Best Practice |

|---|---|---|

| Counterparty | Infrequent audits, solvency rumors | Regularly review official attestations |

| Depeg | Persistent price deviations | Monitor prices across multiple exchanges |

| Technical | Security alerts, protocol incidents | Stick to audited, proven protocols |

| Liquidity | Large spreads, withdrawal delays | Watch TVL and trading volume closely |

| Regulatory | Restriction notices, EU delistings | Stay informed on MiCA and local laws |

Conclusion

Stablecoin yield strategies offer a trade-off between simplicity and control, depending on whether you choose centralized (CeFi) or decentralized (DeFi) platforms. CeFi options like Kraken and Nexo provide predictable returns ranging from 2% to 6% APY, supported by user-friendly interfaces and responsive customer service, making them a solid choice for beginners [2]. On the other hand, DeFi protocols such as Aave and Curve can deliver higher yields – typically between 3% and 10%, and sometimes exceeding 12% – but they require a deeper understanding of wallets, gas fees, and smart contracts [2][13].

Each approach has its risks. CeFi platforms carry the potential for counterparty failures, which could lock your funds, while DeFi users face risks tied to smart contract vulnerabilities, despite the transparency of on-chain systems [3][13]. By Q2 2025, DeFi protocols surpassed CeFi in total value locked, signaling increasing institutional trust in decentralized platforms [3].

Ultimately, the choice between CeFi and DeFi comes down to your expertise and risk tolerance.

Key Takeaways

There’s no one-size-fits-all solution here – the right strategy depends on your comfort with technology and appetite for risk. If you prefer regulatory safeguards and an easy-to-navigate platform, CeFi is the safer bet. However, if you’re an experienced user aiming for higher returns and greater control over your assets, DeFi might be worth the extra effort.

"In crypto, consistency beats chaos. Bear or bull, the best strategy is the one that pays – quietly, steadily, week after week." – Phemex Academy [1]

For a balanced approach, consider diversification: split your capital between reliable CeFi platforms and well-audited DeFi protocols. This way, you can enjoy the stability of CeFi while benefiting from the higher yields DeFi offers. Regularly monitor your investments, verify security audits, and stay updated on regulatory developments that could influence your strategies [2][6].

FAQs

What risks should I consider when using CeFi or DeFi platforms for stablecoin yields?

Both CeFi (centralized finance) and DeFi (decentralized finance) platforms can offer returns on stablecoins, but each comes with its own set of risks.

In CeFi, a central organization oversees your funds. While this might seem straightforward, it exposes users to risks like insolvency, hacks, or sudden changes in terms of service. These platforms typically operate outside traditional banking regulations and don’t provide deposit insurance, which means users could face liquidity issues or even withdrawal freezes. Additionally, regulatory shifts could directly impact their operations, potentially affecting your earnings.

DeFi, on the other hand, removes intermediaries but introduces risks tied to technology. For instance, smart contracts – while innovative – can contain vulnerabilities or be exploited. Similarly, unreliable or manipulated data sources (known as oracles) can result in financial losses. DeFi platforms may also encounter liquidity issues or delays during periods of heavy market activity. And like CeFi, DeFi isn’t immune to regulatory uncertainties, which could disrupt services without warning.

It’s important to weigh these risks carefully before deciding where to allocate your funds.

What’s the difference between CeFi and DeFi platforms when it comes to fund control and custody?

Centralized Finance (CeFi) platforms handle users’ funds through custodial accounts. In simple terms, the platform takes care of holding and securing your assets for you. This setup often makes things easier for users, but it does mean placing trust in the platform’s ability to manage and protect your funds.

Decentralized Finance (DeFi) platforms work differently. They let you maintain full control over your assets by managing your own private keys. While this gives you complete autonomy, it also means you’re fully responsible for keeping your keys and wallets secure – there’s no safety net if something goes wrong.

How can investors reduce risks when using stablecoin yield platforms?

To reduce risks when using stablecoin yield platforms, it’s smart to spread your investments across different assets and providers. Instead of putting all your USD-backed stablecoins (like USDT, USDC, or DAI) into one platform, consider distributing them among several reputable, well-audited protocols and trusted custodial services. This approach lowers the risk of losing funds if a single platform encounters issues. Prioritize stablecoins with clear, reliable peg mechanisms, and explore platforms offering deposit insurance or operating under regulatory oversight for added security.

Before committing funds, make sure to perform detailed research. Check if the platform’s code has been independently audited, verify the credibility of the team behind it, and confirm compliance with U.S. regulations. Staying informed about legal changes and steering clear of risky, time-locked strategies can further protect your investments. Additionally, regularly adjusting your portfolio and setting withdrawal limits can help you navigate market volatility or potential protocol problems more effectively.