Market making relies on liquidity and profit from the bid-ask spread, but managing market depth – the unmatched orders in the order book – is key. In volatile markets, shallow depth can still support quality trade execution if quote refresh rates are high. For example, in April 2025, E-mini S&P 500 futures saw a 68% drop in depth but maintained strong execution quality through rapid updates.

Key strategies include:

- Bid-Ask Spread Quoting: Profits depend on tight spreads and fast quote updates, not just visible depth.

- Dynamic Spread Adjustment: Adjusts spreads in real time based on volatility and order flow, balancing risk and competitiveness.

- Arbitrage Trading: Exploits price differences across markets but requires ultra-fast execution to avoid slippage.

- Order Book Scalping: Focuses on micro price movements, relying on latency-sensitive infrastructure and order book signals.

Each strategy works best in specific conditions, from stable, high-liquidity markets to fragmented or volatile environments. Success depends on matching the approach to market dynamics and having the right systems to manage risks like inventory exposure, adverse selection, and latency.

How Markets REALLY Work – Depth of Market (DOM)

1. Bid-Ask Spread Quoting

Bid-ask spread quoting is the cornerstone of market-making. It involves posting simultaneous buy and sell prices, with profits coming from the difference between the two. However, the real key to success lies in how quickly market makers can update their quotes, not just the amount of liquidity visible in the order book. Let’s dive into how market depth plays into this strategy.

Market Depth and Its Role

The connection between the width of the spread and the depth of the order book isn’t as direct as one might think. While conventional wisdom suggests that narrow spreads require deep order books, real-world markets paint a different picture. For instance, during recent periods of volatility, market makers have shown that rapid quote updates can compensate for shallow market depth. This shift highlights that speed in refreshing quotes often outweighs the importance of displayed depth[1].

Optimal spreads are constantly adjusted based on the changing state of the order book[6]. Market makers who quickly replace filled orders can maintain liquidity, even when the visible depth is thin. For example, in April 2025, a $59 million trade had a price impact of just 5.4 basis points, which is significantly lower than the 10 basis point impact observed for a smaller $33 million trade during the peak of the COVID-19 market volatility in 2020[1].

Managing Risk in Market Making

Beyond market depth, market makers must also address the risks inherent in their role. Two primary risks come into play: inventory risk and price risk. When market makers accumulate too much of an asset, they expose themselves to potential losses from unfavorable price movements. To mitigate this, they adjust their quotes dynamically – lowering the ask price when their inventory is high to encourage selling[5][4].

"A market maker’s bid-ask spread can be decomposed into a portion for the known limit orders, a risk-neutral adjustment for expected market orders, and a risk adjustment for market order and inventory value uncertainty." – Maureen O’Hara and George S. Oldfield, Journal of Financial and Quantitative Analysis[7]

Periods of order flow clustering – when buy and sell orders come in predictable patterns – can boost profitability. Research shows that a 10% increase in clustering can lead to a 12.2% rise in expected profits[3]. On the flip side, manipulative order flows that create fake liquidity can hurt market makers, reducing profitability by 4% for every 10% increase in their occurrence[3].

Operational Demands

Effective bid-ask spread quoting relies heavily on robust operational systems. High-frequency trading infrastructure is essential for continuously updating quotes. Market makers need systems that can monitor inventory in real time, track market conditions, and respond instantly to incoming orders. During periods of intense trading activity, the ability to refresh quotes quickly at the top of the order book becomes critical to meet the demand from aggressive trades[1].

These systems must also handle complex adjustments, factoring in inventory levels, order book dynamics, and market volatility. Additionally, market makers need consistent access to funding and hedging markets to manage the positions they accumulate throughout the day[8].

Best Market Conditions for This Strategy

This approach thrives in markets with high trading activity and steady order flow. Narrow spreads are most effective when trades are executed quickly and costs are low[8]. For example, during calmer periods in March 2025, the 90th percentile of price dispersion for E-mini S&P 500 futures was just 4.1 ticks. However, this jumped to 10.8 ticks during the volatility peak in April 2025[1].

When volatility spikes, market makers adjust by widening spreads and reducing displayed depth. Despite these changes, execution quality remains high because of the rapid rate at which quotes are refreshed. For traders, this means focusing on quote refresh rates rather than the volume resting in the order book, as high refresh rates ensure smooth execution even when the visible depth is minimal[1].

2. Dynamic Spread Adjustment

Dynamic spread adjustment takes the concept of bid-ask spread quoting to a new level by actively reacting to market changes. This approach continuously fine-tunes bid-ask spreads based on real-time data. By analyzing factors like volatility, order flow patterns, and inventory levels, algorithms adjust spreads dynamically. For instance, spreads widen during volatile periods to manage risk and narrow during calmer times to remain competitive [11].

Market Depth Dependency

Contrary to traditional assumptions, market depth isn’t always the main factor driving dynamic spread adjustments. While thin order books are often associated with wider spreads, the reality is more complex. A striking example is the market response during the April 7, 2025 tariff-induced volatility event. E-mini S&P 500 futures saw a 68% drop in order book depth, yet dynamic adjustments enabled market makers to maintain high execution quality through faster quote updates [1].

"A high quote refresh rate can allow incoming buy and sell orders to be filled without a significant price change, even if the order book depth is lower than in a calmer trading environment." – CME Group [1]

This shift from focusing solely on order book depth to prioritizing execution quality marks a major evolution in market-making strategies. Instead of relying on resting volume, sophisticated market makers now evaluate metrics like price impact and fill quality. For example, during the same April 2025 event, price dispersion widened by 6.7 ticks compared to stable conditions in March. However, the market impact for a $59 million trade was just 5.4 basis points – half the 10 basis points observed during the 2020 COVID-19 volatility [1].

These adjustments are tightly linked to risk management, a topic explored further below.

Risk Profile

Dynamic spread adjustment comes with its own set of challenges, particularly the risk of priority loss. In order-driven markets with price-time priority, every time a quote’s price or size is adjusted, it moves to the back of the queue [9]. This creates a delicate balance: adjust too often, and your orders may never execute; adjust too slowly, and you risk exposure to unfavorable price changes.

To mitigate these risks, sophisticated market makers rely on predictive models. By forecasting short-term price movements, they can adjust quotes ahead of trends, reducing inventory risk while keeping spreads tight [2]. Volume-based adjustments also play a role. For example, when faced with aggressive institutional trades that may indicate informed activity, spreads automatically widen to manage risk [11].

Inventory management further refines the process. A market maker holding a long position might offer a more competitive ask price while widening the bid to encourage selling.

Operational Requirements

Dynamic spread adjustment demands cutting-edge infrastructure. Execution speeds measured in microseconds are critical for profitability, requiring co-location services, direct market access, and hardware capable of processing millions of price updates per second [11]. These systems must handle adjustments for hundreds of instruments in milliseconds.

To ensure smooth operations and prevent issues like quote stuffing, two key safeguards are in place: Quote Throttles (introducing slight delays between updates) and Fill Throttles (pausing quoting briefly after a trade) [12]. Additionally, independent risk engines continuously monitor positions and can trigger protective measures, such as spread widening during extreme market volatility [11].

This sophisticated setup ensures dynamic spread adjustments remain effective across different market conditions.

Market Conditions Suitability

Dynamic spread adjustment proves particularly useful during market opens and closes when uncertainty peaks, as well as during periods of high order flow toxicity [1] [11]. In cryptocurrency markets, where automation and risk management are heavily utilized, trading spreads have significantly decreased, showcasing the effectiveness of dynamic adjustments [10].

"For any amount of risk, liquidity providers are now willing to show smaller spreads. In other words the cost of crypto market risk is lower today." – Max Boonen, Founder, B2C2 [10]

However, in highly liquid markets, the discrete nature of price ticks can limit the effectiveness of dynamic adjustments. For instance, in liquid instruments like E-mini S&P futures, orders placed just one tick away from the best bid or ask have an execution probability of less than 3% [9]. This makes dynamic adjustments most advantageous in markets with sufficient tick granularity, where predictive modeling offers a competitive edge over more passive strategies.

3. Arbitrage Trading

Arbitrage trading is a strategy that takes advantage of price differences caused by market liquidity conditions. Unlike liquidity provision strategies, which focus on maintaining consistent market activity, arbitrage trading zeroes in on temporary price gaps to secure profit opportunities. This often involves buying an asset at a lower price on one platform and simultaneously selling it at a higher price on another. Another common method, triangular arbitrage, exploits price mismatches among three trading pairs on the same exchange.

Market Depth and Its Role

The success of arbitrage trading heavily depends on market depth, as it dictates whether trades can be executed without significantly shifting prices. In liquid markets, large trades can occur with minimal disruption. However, in markets with thin order books, trades may push prices deeper into the book, increasing costs and potentially wiping out profits [1][13]. This becomes even more challenging during periods of high volatility, when market depth can rapidly diminish just as arbitrage opportunities emerge.

Take the April 2025 volatility event as an example: despite a 68% drop in order book depth, the market processed a 99% surge in trading volume. A $59 million trade during this time caused a 5.4 basis point market impact, significantly lower than the 10 basis point impact of a smaller $33 million trade during the 2020 COVID-19 volatility [1]. This highlights that the quality of trade execution – how closely the execution price matches the expected arrival price – can matter more than static depth figures.

The real challenge arises in fragmented markets, where one side of an arbitrage trade might lack sufficient depth. If a trade causes slippage on the thinner venue, the profit opportunity can disappear entirely [13]. This interplay between market depth and execution costs directly shapes the risks involved in arbitrage trading.

Risks in Arbitrage Trading

Arbitrage trading is all about seizing fleeting opportunities, but it comes with its own set of risks. One of the biggest concerns is legging risk, which happens when one side of a trade is executed while the other isn’t. This can occur due to rapid price changes or insufficient depth on one side of the trade [14][13]. During volatile periods, this risk increases, and arbitrageurs may also face toxic order flow, where stale quotes are exploited before the second leg of the trade is completed [1][13].

Event risk is another factor, especially in prediction markets. Sudden news can lead to drastic price swings, such as a jump from 0.50 to 0.90, leaving positions worthless in seconds [14]. For example, in November 2025, prediction market platforms Kalshi and Polymarket saw combined monthly volumes of nearly $10 billion ($5.8 billion and $3.74 billion, respectively). While this created plenty of arbitrage opportunities, it also exposed traders to the binary risks of these markets [14].

Spatial arbitrage, which involves trading across different exchanges, adds another layer of complexity. Traders must pre-position capital on all target venues to avoid delays caused by withdrawal times, which can erase profits. This approach also centralizes risk, as downtime or insolvency on one exchange can disrupt the entire strategy [13].

What Arbitrage Requires

To succeed in arbitrage trading, having the right tools and infrastructure is non-negotiable. Automated trading systems must process real-time data from multiple venues and execute trades within milliseconds [13]. Many firms use dedicated virtual private servers (VPS) or co-location services to achieve sub-10ms latency [14][13]. For example, crypto exchanges like Kraken now offer co-location services, providing traders with ultra-low latency connections, which gives them an edge over smaller operations [13].

These systems also need to integrate with exchange protocols like REST, WebSocket, and FIX while managing challenges like rate limits and latency [13]. Kill-switches are critical to halt trading during unexpected exchange downtimes or connection issues [13]. Advanced monitoring tools, such as Volume-Synchronized Probability of Informed Trading (VPIN), help detect toxic order flow and minimize risks when adverse selection spikes [13]. Professional-grade infrastructure ensures consistent uptime and fast execution, which is essential for staying competitive in this fast-paced environment [14].

When Arbitrage Works Best

Arbitrage opportunities are most common in fragmented markets, especially during periods of high volatility or major news events like CPI releases, Federal Reserve announcements, or unexpected trade policies [1][14][13]. In prediction markets, typical returns range from 0.5% to 3%, but these windows often close within seconds as high-frequency trading (HFT) firms step in to narrow spreads [14].

The growing presence of traditional HFT firms in crypto and prediction markets has made arbitrage more competitive, reducing the duration of opportunities [13]. This means that speed and efficiency are more critical than ever. Optimized infrastructure can make the difference, allowing traders to capture opportunities before they disappear. Maker-taker fee structures on exchanges can also boost profits, with rebates (e.g., -0.01%) helping to improve margins [13].

Ultimately, arbitrage trading is limited by liquidity. Large trades in thin markets can move prices significantly, erasing potential profits. The strategy works best when there’s enough depth on both sides of the trade to allow for simultaneous execution without slippage. Success in arbitrage requires quick, precise execution to capitalize on fleeting market inefficiencies.

sbb-itb-c5fef17

4. Order Book Scalping

Order book scalping is a fast-paced trading strategy that builds on earlier approaches, using real-time market depth signals to capture quick profits. This method involves seizing small gains from brief price fluctuations by rapidly placing and canceling orders – often within milliseconds. Unlike arbitrage, which takes advantage of price differences across various markets, scalping hones in on micro-movements within a single order book. Traders typically place limit orders at the best bid or ask prices, aiming to profit from the spread while keeping the risk of unfavorable price shifts to a minimum. Success in this strategy hinges on understanding queue dynamics – essentially, the price-time priority system that dictates which orders are executed first.

Market Depth and Scalping

The depth of the market plays a critical role in the success of scalping strategies. In shallow markets, even a single large order can disrupt the order book, leading to progressively worse execution prices and cutting into potential profits. Scalpers closely monitor order book imbalances to gauge short-term price pressures. A significant imbalance might indicate that the market could move against resting orders, increasing the risk of adverse selection.

According to CME Group, quick quote refreshes can help offset low resting volumes, making rapid updates more valuable than static depth measures [1]. Additionally, scalpers often encounter an inverse correlation between how easily an order is filled and the likelihood of favorable returns. Orders filled too quickly may signal that the market is about to move unfavorably [16]. To counter this, many scalpers take a contrarian stance, placing orders against the prevailing imbalance to increase their chances of success.

Risks of Scalping

Scalping comes with its own set of risks, especially during volatile market conditions. Similar to broader market-making strategies, the ability to adjust quotes swiftly is essential for managing risk. One major concern is adverse selection – traders may find their orders executed just as the market turns against them. High-frequency traders (HFTs) often maintain order-to-trade ratios in the thousands, with cancellation rates exceeding 90% [15]. This means that visible liquidity can vanish in the blink of an eye.

Market manipulation is another challenge. Techniques like spoofing – where false orders are placed to create a misleading impression of market activity – can trap scalpers in poor positions. Research shows that a 10% rise in manipulative limit orders can reduce expected profits by 4%, while genuine clustering of market orders can increase profitability by 12.2% for every 10% rise in such activity [3].

Latency is also a significant risk. As Jack Williams from Moss.sh explains:

"Depth seen now may be stale in milliseconds during high activity" [15].

For example, during the April 2025 volatility spike, the 90th percentile price dispersion widened dramatically – from 4.1 ticks to 10.8 ticks in just one second [1].

What Scalping Requires

To execute scalping effectively, traders need co-location services and specialized infrastructure to minimize latency and manage thousands of updates per trade while maintaining data accuracy. Access to Level 3 market data – offering detailed information about individual orders, including IDs and changes – is critical. This level of granularity helps traders identify hidden "iceberg" orders and detect manipulation patterns [17]. In contrast, Level 2 data, which aggregates volume at different price levels, lacks the precision required for high-speed scalping.

Statistical tools also play a key role in filtering out noise from high-frequency trading. For instance, orders that remain on the book for less than 50 milliseconds can be flagged as potential noise [17]. Real-time benchmarks like VWAP (Volume Weighted Average Price) allow traders to adjust dynamically – for example, pausing execution when liquidity dries up – to limit adverse price impacts [17]. Scalping, like other market-making strategies, relies heavily on low-latency systems for real-time decision-making and execution.

Best Market Conditions for Scalping

Scalping works best in stable, high-volume markets where order book depth is consistent, and quotes are updated frequently. A prime example is the E-mini S&P 500 futures market, which boasts an average daily trading value roughly 11 times larger than the combined value of the three biggest S&P 500 ETFs [1]. However, during periods of increased volatility, scalpers often shift to a more cautious approach, using "post-only" limit orders to act as liquidity providers rather than takers [15].

In fragmented or low-volume markets, even small orders can cause significant price swings. With high-frequency trading now accounting for 50–70% of total volume in U.S. equity and futures markets [3], having the right infrastructure and speed is essential to staying competitive in this space.

Pros and Cons

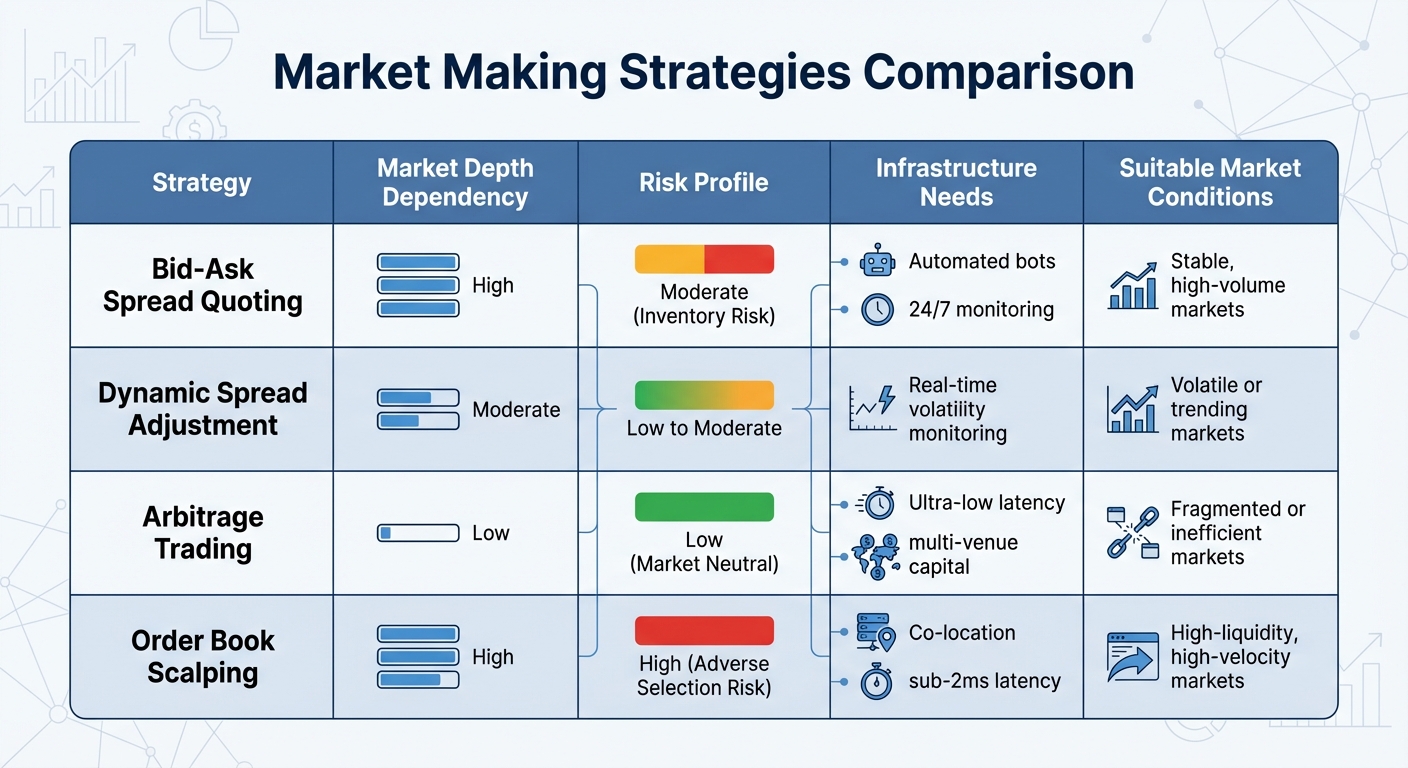

Market Making Strategies Comparison: Depth Dependency, Risk, and Infrastructure Requirements

Market depth plays a crucial role in shaping both the risks and operational demands of various trading strategies. Each market-making approach comes with its own set of advantages and challenges, as highlighted in the strategy analyses above.

Bid-Ask Spread Quoting performs best in stable, high-volume markets where consistent depth supports tighter spreads and reduces inventory risk. However, in markets with low liquidity, even a single large order can disrupt the order book, forcing wider spreads to mitigate the risk of sudden price swings [2][18].

Dynamic Spread Adjustment is designed to adapt to changing market conditions. By tracking real-time volatility and imbalances in the order book, this strategy works well in both deep and shallow markets. That said, it comes with significant operational challenges – it requires advanced algorithms and constant monitoring to avoid adverse selection. This is particularly important in low-liquidity environments, where informed traders may exploit outdated quotes [13][18].

Arbitrage Trading is less reliant on the depth of any single market. By capitalizing on price differences across multiple exchanges, it remains effective even in thinly traded markets. The downside is that it demands ultra-low latency infrastructure and pre-positioned capital at various venues. For example, spatial arbitrage necessitates distributing capital across exchanges, while triangular arbitrage requires execution speeds measured in sub-milliseconds to seize fleeting opportunities [13].

Order Book Scalping thrives in deep, fast-moving markets where frequent updates to quotes help maintain liquidity. However, this strategy is highly demanding in terms of infrastructure, requiring co-location services and latency below 2 milliseconds. AlphaLab Capital, for instance, reported achieving sub-2ms latency in cryptocurrency markets, though they noted this was still slower compared to traditional financial markets [19]. In shallow markets, scalping becomes nearly unworkable, as even small orders can lead to adverse selection.

By understanding these trade-offs, firms like Bestla VC can fine-tune their approaches to digital finance. The table below provides a concise comparison of these strategies:

| Strategy | Market Depth Dependency | Risk Profile | Infrastructure Needs | Suitable Market Conditions |

|---|---|---|---|---|

| Bid-Ask Spread Quoting | High | Moderate (Inventory Risk) | Automated bots, 24/7 monitoring | Stable, high-volume markets |

| Dynamic Spread Adjustment | Moderate | Low to Moderate | Real-time volatility monitoring | Volatile or trending markets |

| Arbitrage Trading | Low | Low (Market Neutral) | Ultra-low latency, multi-venue capital | Fragmented or inefficient markets |

| Order Book Scalping | High | High (Adverse Selection Risk) | Co-location, sub-2ms latency | High-liquidity, high-velocity markets |

Conclusion

Market depth plays a critical role in determining the success of market-making strategies in live trading environments. There’s no one-size-fits-all approach – each strategy must align with factors like market depth, volatility, and the trader’s operational resources.

The data highlights some clear trends: bid-ask spread quoting and order book scalping thrive in deep, stable markets, whereas arbitrage trading and dynamic spread adjustments can still perform well in thinner liquidity conditions. For traders managing capital between $5,000 and $25,000 and employing semi-automated strategies across multiple markets, monthly returns of $200–$1,000 are within reach[14]. On the other hand, scaling up to $100,000 or more with professional-grade infrastructure can boost monthly returns to $5,000–$20,000 or more[14]. However, these outcomes depend heavily on matching the strategy to the market’s depth and conditions.

"The overall goal of the crypto market making strategy and market-making activity always remain the same: make it easier for other people to transact what they want, when they want."

– Caladan Group[19]

For digital finance firms, such as those in Bestla VC’s portfolio, understanding these trade-offs is crucial for navigating complex market dynamics. Historical volatility events have shown that markets can sustain liquidity with high quote refresh rates, even when visible depth diminishes significantly[1].

To optimize performance, align strategies with market depth, volatility, and infrastructure capabilities. In stable, high-liquidity markets, maintain tight spreads of 0.5–2%, but widen them to 5–10% during periods of heightened volatility or reduced liquidity[20]. Beyond monitoring resting volume, focus on metrics like fill quality and quote refresh rates to better assess a market’s true absorptive capacity. For high-frequency strategies or order book scalping, prioritize sub-2ms latency and co-location services to minimize risks in fast-moving markets[19]. Ultimately, combining operational precision with market depth insights will be key to achieving consistent and effective execution in digital finance.

FAQs

How does market depth affect bid-ask spread strategies in market making?

Market depth is a key factor that directly impacts the success of bid-ask spread strategies. When there’s greater market depth – meaning a higher volume of resting orders – market makers can offer tighter, more consistent bid-ask spreads. This creates a more stable trading environment, reducing risks and enhancing liquidity for participants.

On the flip side, limited market depth poses challenges. With fewer orders available, liquidity becomes constrained, and market makers often have to widen spreads to account for the higher risk and potential price swings. This can lead to less efficient quoting and increased price volatility. For market makers, understanding and adjusting to market depth is crucial for fine-tuning their strategies and maintaining efficiency.

How does adjusting the bid-ask spread help market makers manage risk during volatile markets?

Managing the bid-ask spread is a vital tactic for market makers, especially during periods of high volatility. By increasing the spread when market depth thins out or price swings become more intense, market makers can shield themselves from executing trades at unfavorable prices and limit potential losses on their inventory.

Dynamic algorithms are central to this process. These tools continuously analyze real-time market data and adjust spreads automatically to strike a balance between risk and reward. This is particularly critical in unpredictable markets, where sharp price movements can disrupt inventory levels. Companies like Bestla VC integrate these advanced systems into their digital finance platforms, ensuring liquidity is maintained while keeping exposure to sudden market changes under control.

Why is high-speed infrastructure important for successful arbitrage trading?

In arbitrage trading, speed isn’t just an advantage – it’s a necessity. High-speed infrastructure allows traders to seize fleeting price differences across markets before they vanish. With ultra-low latency, transactions can be executed in mere fractions of a second, giving traders a critical edge over market adjustments.

In this highly competitive space, even a delay as small as a microsecond can turn a potential win into a loss. By leveraging advanced infrastructure, traders can outpace competitors, ensuring faster execution and increasing the likelihood of capturing profitable opportunities.