DAO venture capital, or Venture DAOs, is reshaping how early-stage investments work by combining blockchain technology with community-driven decision-making. These organizations pool funds, vote on investments, and distribute profits transparently using smart contracts. Unlike traditional venture capital, DAOs offer open participation, lower barriers to entry, and real-time insights into financial operations. Here’s a quick overview:

- What are Venture DAOs? Groups using blockchain to manage pooled capital for investing in startups and Web3 projects.

- How do they work? Members contribute funds, vote on proposals, and share returns through automated smart contracts.

- Benefits: Transparency, accessibility, and shared profits for a broader range of participants.

- Challenges: Legal risks, smart contract vulnerabilities, and governance issues.

Legal structures like Delaware LLCs and compliance measures such as KYC/AML help DAOs operate securely. Emerging trends include hybrid models combining DAOs with venture firms, AI-driven analytics, and niche-focused DAOs targeting areas like AI-Web3 and Bitcoin tools. DAO venture capital is opening new paths for investors and founders alike, with collaboration, transparency, and blockchain at its core.

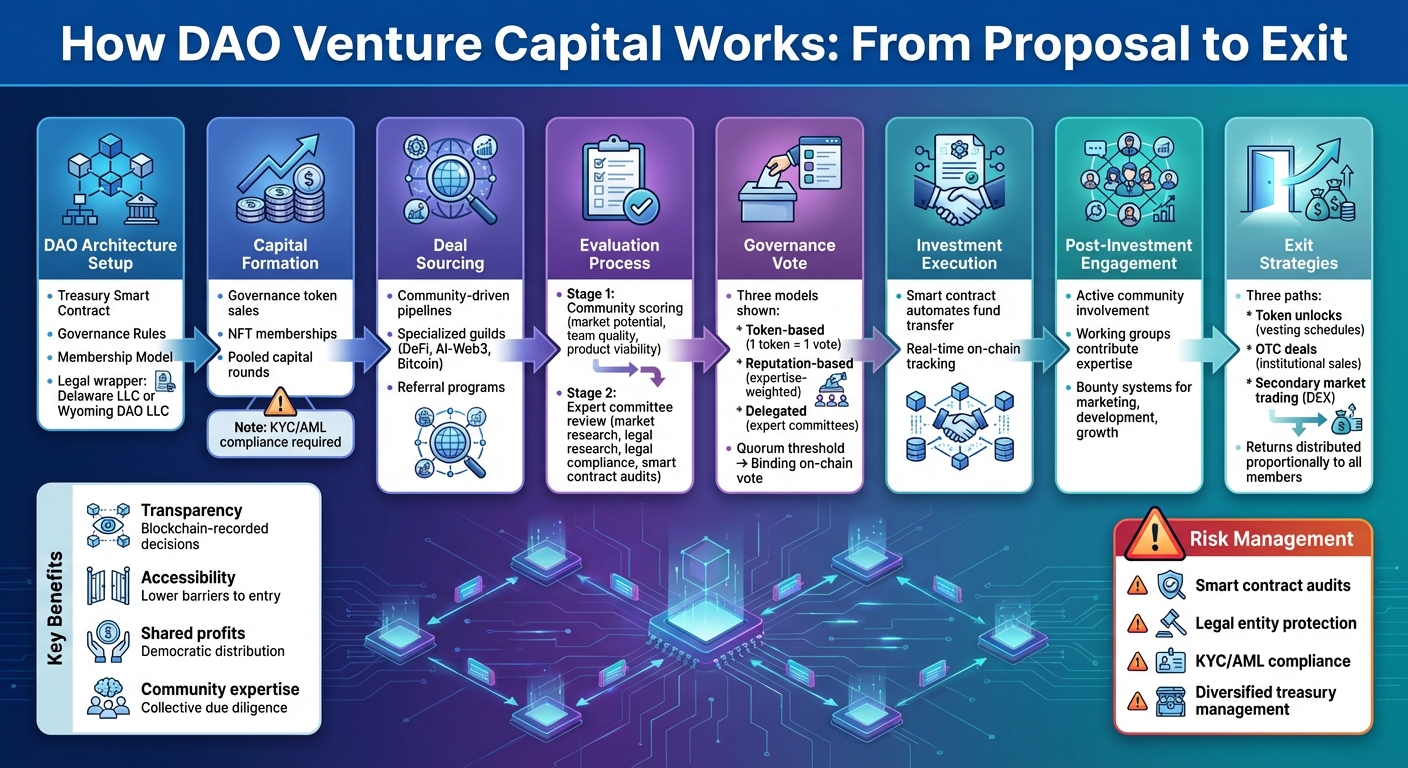

How DAO Venture Capital Works: From Proposal to Exit

Core Components of DAO Venture Investing

DAO Architecture for Venture Capital

The structure of a Venture DAO blends technical and organizational elements, all anchored on the blockchain. At its heart is a treasury smart contract that holds pooled funds, whether in ETH, stablecoins, or other tokens, and operates under predefined voting rules.

These governance rules dictate how decisions are made. Smart contracts encode voting systems – whether it’s one token equaling one vote or reputation-based models – while also setting quorum requirements and execution thresholds. Members submit proposals, and once approved, the smart contract automatically handles fund transfers or returns.

Membership models can differ. In token-based systems, anyone holding governance tokens can participate in decision-making. Share-based or "guild" models, on the other hand, require approval from existing members. For example, The LAO uses token-based governance for contributions, voting, and fund allocation, while also allowing members to "rage quit" and withdraw their proportional share of the treasury if they choose to leave[1][2][3][5].

Beyond the blockchain, tools like Discord and Snapshot facilitate discussions and voting. Legal entities, often structured as Delaware LLCs, are also part of the equation, helping to manage liability and tax concerns. Members typically discuss investment opportunities off-chain, formalize proposals, vote using governance tools, and execute approved investments through the treasury smart contract.

These interconnected systems form the backbone of Venture DAOs, supporting the different models outlined below.

Types of Venture DAOs

Venture DAOs generally fall into three main categories:

- Member-managed DAOs: These are community-driven groups where members pool capital and collectively decide on investments. The LAO is a prime example, using token-based governance combined with a Delaware LLC structure for legal protection[1][2][3].

- Ecosystem DAOs: These DAOs focus on a specific blockchain or protocol, investing in projects that enhance their ecosystem. Investments often target infrastructure or developer tools to strengthen their network[3].

- Diversified investment DAOs: These DAOs spread their investments across various asset classes, including Web3 startups, tokens, and sometimes traditional equities. For example, Orange DAO uses smart contracts to enforce membership criteria while diversifying investments, and Komorebi Collective prioritizes funding female and non-binary crypto founders[1][3].

Each model has its strengths and weaknesses. Member-managed DAOs encourage inclusive decision-making but can face challenges if token holders remain inactive. Share-based models often lead to better due diligence but may limit participation. Ecosystem DAOs bring strategic focus but may lack diversification[1][3][5].

Understanding these models helps highlight the unique opportunities they offer to both investors and founders.

Value Propositions for Investors and Founders

DAO-based venture capital brings several advantages compared to traditional setups. For investors, one of the biggest benefits is broader access. Traditional VC funds often limit participation to accredited institutional investors or a small circle of decision-makers. DAOs, however, allow a wider range of individuals to pool resources and invest in early-stage opportunities, breaking down barriers that previously excluded many.

Returns are distributed based on governance rules, ensuring that all members share in the success of investments. Additionally, the collective nature of DAOs can enhance deal quality, as members contribute their research, networks, and expertise during the due diligence process.

For founders, raising funds through a DAO offers more than just capital. It provides access to a diverse and engaged investor community, which can serve as early adopters, advocates, and contributors to the project’s growth. This involvement can help accelerate product adoption and strengthen the overall ecosystem. Moreover, the transparency of blockchain-recorded decisions and treasury activities gives founders clear visibility into investor actions and alignment with their project’s goals.

The combination of improved governance structures and diverse DAO models creates a compelling framework that benefits both investors and founders, showcasing the transformative potential of DAO-based venture capital.

What is AI16Z? – AI-Driven DAO Venture Capital Investing Explained

Legal and Structural Frameworks for DAO Venture Capital

For DAO-based venture capital initiatives to thrive, having a solid legal and structural foundation is crucial. These frameworks safeguard members while ensuring smooth operations.

Legal Entities for Venture DAOs

In the absence of a legal wrapper, DAO participants in the U.S. face significant risks. Without formal incorporation, DAOs are treated as general partnerships under U.S. law. This means members share liability for the DAO’s debts and legal claims – a scenario that serious investors simply cannot accept[1].

To address this, most venture DAOs establish legal entities to hold assets and sign contracts. Two popular choices are Wyoming DAO LLCs, which integrate smart contract governance into their legal structure, and Delaware LLCs, valued for their reliable case law and flexible agreements[1].

For global token projects, entities like Cayman foundations and exempted companies are often used. These provide tax efficiency for non-U.S. investors and serve as neutral jurisdictions for international capital. However, they come with added complexity and annual costs that can exceed $10,000 for institutional setups. Similarly, Swiss foundations are more suited for protocol DAOs and grant-making activities rather than venture investments.

The choice of structure depends on factors like the investor base, types of assets, and familiarity with legal systems. For instance:

- U.S. LLCs are ideal for DAOs focused on American participants and traditional startup equity.

- Offshore entities work better for global token strategies involving diverse investor groups.

U.S. Regulatory Requirements

Many DAO tokens are classified as securities under the Howey test, which assesses whether profits are expected from the efforts of others. This designation brings DAOs under U.S. securities laws[1].

When a venture DAO pools investor funds to invest in securities, it risks being classified as an investment company. To avoid this, DAOs often rely on exemptions like:

- 3(c)(1): Limits the number of beneficial owners to 100.

- 3(c)(7): Requires all investors to be "qualified purchasers" (individuals with at least $5 million in investments or entities with at least $25 million)[1].

Venture DAOs also frequently use Regulation D (Rule 506(b) or 506(c)), which restricts sales to accredited investors and limits general solicitation.

Compliance with KYC/AML regulations is another critical area. Even if the DAO itself isn’t a registered financial institution, its associated LLC, foundation, or service providers might trigger obligations under the Bank Secrecy Act (BSA) or FinCEN rules when handling funds or issuing tokens[2]. To address this, many DAOs use third-party KYC/AML solutions, maintaining a verified membership list while preserving some level of pseudonymity.

The CFTC’s Ooki DAO enforcement action in 2022 served as a wake-up call. The Commission imposed a $600,000 penalty, holding tokenholders who participated in governance votes accountable as members of an unincorporated association. This case has driven DAOs to adopt clearer legal structures and compliance practices.

Taxation adds another layer of complexity. A venture DAO wrapped in an LLC is generally treated as a partnership for U.S. tax purposes. Income and losses are passed through to members, requiring them to track token distributions, airdrops, and portfolio transactions meticulously, with values recorded in U.S. dollars at the time of each event. Skilled managers often coordinate tax strategies across U.S. and offshore entities to align with investor needs and the digital asset mix.

These regulatory and tax challenges highlight the importance of combining legal frameworks with on-chain governance.

Hybrid Structures and On-Chain Governance

To balance decentralized decision-making with legal compliance, many venture DAOs adopt hybrid models. These frameworks divide responsibilities: an off-chain entity (like a Delaware LLC or Cayman fund) holds contracts, while tokenholder votes guide strategy[1].

The off-chain entity’s operating agreements or fund documents often reference the DAO’s smart contract governance. They delegate specific decisions to token votes while including legal vetoes and compliance carve-outs. Treasury multisigs – controlled by elected signers or managers – execute on-chain votes, ensuring alignment between legal ownership and community decisions.

For DAO decisions to be recognized legally, foundational documents must clearly define the DAO, its smart contracts, and voting processes. Operating agreements should bind managers to follow valid on-chain votes unless doing so would violate laws or regulations[1]. Many DAOs also maintain governance schedules that link on-chain actions – like proposal thresholds or quorum requirements – to corresponding off-chain obligations.

Platforms like Syndicate and Doola simplify this process by offering tools to create U.S. investment club LLCs with integrated on-chain governance features. These platforms automate much of the paperwork while ensuring compliance with legal and regulatory standards[4].

These hybrid models effectively connect decentralized governance with necessary legal oversight, offering a practical path forward for venture DAOs.

Governance, Capital Formation, and Deal Sourcing

After a venture DAO establishes its legal framework, the next step is setting up systems for decision-making, raising capital, and sourcing deals. These operational components are key to determining whether a DAO can hold its own against traditional venture firms.

DAO Governance Models for Venture Strategies

Venture DAOs generally adopt one of three governance models, each with its own pros and cons. Token-based governance operates on a one-token-one-vote principle, directly tying financial contributions to voting power. While straightforward and transparent, this system can lead to large token holders dominating decisions[3]. Reputation-based governance shifts the focus from capital to expertise, assigning voting power based on non-transferable reputation points earned through contributions like deal sourcing or due diligence. This approach prioritizes skill over money but can be slower to implement and harder to quantify objectively[5].

Delegated governance allows token holders to transfer their voting power to selected delegates or committees. This model concentrates decision-making among experts while still allowing the community to oversee and reassign votes if needed. For venture investing, where quick decisions and expertise are critical, delegated governance strikes a practical balance[1][3]. Many successful venture DAOs combine these governance methods to manage strategic decisions and approve deals effectively.

The governance process typically unfolds in stages. Discussions often begin on platforms like Discord or Discourse, followed by formal proposals detailing aspects such as team background, market analysis, tokenomics, and legal structure. A signaling vote gauges interest, leading to a binding on-chain vote. Smaller checks might follow fast-track procedures, with quorum thresholds adjusted based on deal size and risk. Smart contracts then automate execution[1][2][3].

Capital Formation Mechanisms

Once governance is in place, the focus shifts to raising capital to fund investments. Venture DAOs employ several methods for this:

- Governance token sales: These can be public or private. Public sales offer wider access and liquidity but face regulatory scrutiny in the U.S. if the tokens are tied to profit rights[1].

- NFT-based memberships: NFTs can grant access to deal flow and governance rights. While emphasizing community participation, they may still face classification as securities if linked to profit expectations[3][5].

- Pooled capital rounds: These are closer to traditional fund structures, often limited to accredited U.S. investors who complete KYC/AML checks. Smart contracts streamline processes like deposits, capital calls, and distributions[1][2].

To balance inclusivity with compliance, many U.S.-focused DAOs combine methods – for example, running private token sales for accredited investors while offering non-economic participation for the broader community[1].

Treasury management plays a crucial role in ensuring capital efficiency. DAOs diversify holdings across stablecoins, ETH, BTC, and governance tokens, often deploying funds into DeFi protocols for yield through lending or liquidity provision. Smart contracts enforce rules like limiting exposure to volatile assets and automatically rebalance portfolios. Tools such as time-locked vaults or streaming contracts align funding availability with project milestones, reducing risks of misuse while maintaining transparency through on-chain dashboards[1][2][4].

Deal Sourcing and Evaluation in DAOs

With governance and capital secured, identifying and evaluating high-potential opportunities becomes the priority. Venture DAOs excel in community-driven pipelines supported by expert oversight. Leading DAOs use open sourcing channels, referral programs, and specialized guilds focused on sectors like DeFi, AI-Web3, or Bitcoin projects[1][3]. Members submit opportunities via detailed forms covering team credentials, traction, legal jurisdiction, and token or equity structure, minimizing low-quality submissions[2].

To incentivize contributions, DAOs reward members with reputation points, bonus tokens, or carried-interest profit shares when sourced deals succeed or reach exit milestones[1]. Sector-specific guilds pre-screen deals before presenting them to the broader DAO, leveraging domain expertise and reducing decision fatigue for general members[1][3]. U.S.-focused DAOs also implement compliance filters to manage legal risks, such as avoiding unregistered public offerings[1].

Evaluation typically follows a two-tier process. The first stage involves community-wide input, where members score opportunities based on factors like market potential, team quality, product viability, and token design[2]. Promising deals then move to specialized committees – elected members with expertise in areas like venture capital, technical analysis, legal compliance, or specific domains. These committees conduct in-depth reviews, including market research, term sheet analysis, smart contract audits, cap table evaluations, and regulatory risk assessments[1].

Firms like Bestla VC often collaborate with DAOs as expert committees or co-investors, particularly in complex areas like AI-Web3 intersections, advanced cryptography, or Bitcoin-focused projects. With a team experienced in law, mathematics, physics, computer science, and blockchain consulting, they bring specialized due diligence capabilities that complement community-driven efforts. On-chain reputation tracking for reviewers adds rigor to the process while maintaining transparency[1][2].

sbb-itb-c5fef17

Executing and Managing DAO Venture Investments

Once a proposal clears the governance process, the DAO shifts from evaluation to execution. At this stage, smart contracts take over, automating key functions like collecting member contributions and creating an audit trail. This automation offers a level of transparency and efficiency that traditional venture capital structures struggle to achieve [1]. It’s the point where the investment truly comes to life.

The Venture Investment Lifecycle

In DAOs, the venture investment process follows a unique path shaped by decentralized decision-making. Community members identify potential opportunities, and specialized committees conduct due diligence before proposals are submitted for formal voting. Once approved, smart contracts execute the fund transfers, bypassing delays often caused by intermediaries [1]. DAOs then monitor their portfolios in real-time using on-chain data and periodic updates.

Take the LAO, for example – a leading venture DAO structured as a Delaware LLC. It uses smart contracts to handle member contributions and distribute profits, all while maintaining limited liability protection [1].

A growing trend in this space is the hybrid model, which combines DAOs with traditional venture capital firms. In this setup, the VC firm handles deal sourcing and initial evaluations, leveraging professional expertise, while the DAO focuses on capital formation and community governance [1]. Orange DAO, founded by Y Combinator alumni, exemplifies this approach. It blends professional deal flow with decentralized governance, demonstrating how these hybrid models can combine the best of both worlds. Research suggests that such arrangements often achieve better outcomes by pairing expert evaluation with the DAO’s distributed capital and resources [1]. Once the deal is executed, the community plays a pivotal role in shaping the investment’s ongoing success.

Post-Investment Engagement

In contrast to the passive board oversight typical of traditional venture capital, DAOs emphasize active community involvement after an investment is made. Token holders participate directly in portfolio company decisions, ensuring that all members share in the potential rewards, not just a select few [3]. Additionally, working groups made up of members with relevant expertise contribute to areas like strategy and operations [1].

DAOs also use bounty systems to encourage contributions in areas such as marketing, technical development, or business growth. Members are rewarded for their efforts, creating a dynamic, collaborative environment where portfolio companies can thrive [1]. This hands-on engagement model leverages the collective expertise and resources of the community. For instance, firms like Bestla VC often work alongside DAOs as expert committees or co-investors, particularly in specialized fields like AI-Web3 integrations or Bitcoin-focused projects. This collaboration enhances due diligence and strengthens the DAO’s overall investment strategy.

Exit and Liquidity Strategies

DAO exit strategies are designed to reflect their commitment to collective benefit. Token unlocks, for instance, allow investee tokens to become liquid based on predetermined vesting schedules encoded in smart contracts. This enables members to realize returns gradually as portfolio companies grow [1]. DAOs can also negotiate over-the-counter (OTC) deals, selling directly to institutional investors without relying on public markets [4]. Bestla VC’s OTC model, for example, minimizes market impact through tight spreads and flexible volume options.

Another option is secondary market trading, where individual token holders can sell their shares on decentralized exchanges without requiring the entire DAO to exit [3]. While these liquidity options provide flexibility, they also come with challenges. Coordinated exits, for example, can disrupt token prices. To mitigate this, DAOs need strong governance mechanisms to manage exit timing and communicate strategies clearly. Unlike traditional VC models, where returns often concentrate among a few general partners, DAO exits distribute benefits proportionally, staying true to their democratic foundation [3].

Risks, Compliance, and Future Trends in DAO Venture Capital

Risks for DAO Venture Investors

Investing in DAO venture capital comes with its own set of challenges. One of the biggest concerns is smart contract vulnerabilities. A single flaw in the code can lead to catastrophic losses. Take the 2016 DAO hack, for example – it siphoned off approximately 3.6 million ETH, valued at around $50 million to $60 million at the time. This incident, which followed a record-breaking crowdfunding effort that raised roughly $150 million from over 11,000 investors, forced Ethereum to undergo a controversial hard fork and highlighted the critical need for better security measures [5][6].

Another major issue is legal and regulatory uncertainty. Without proper legal structures, DAO participants – especially active token holders – could face unlimited personal liability for the DAO’s actions or regulatory breaches [1][7]. Securities laws further complicate the landscape. Governance tokens or profit-sharing tokens often trigger scrutiny under the Howey test, potentially requiring registration or exemptions. If a DAO pools funds and makes investment decisions, it could be classified as an investment company or private fund, which would bring it under the purview of the Investment Company Act and Investment Advisers Act [1].

Governance challenges also pose risks. Low voter turnout can concentrate decision-making power in the hands of a few, leading to rubber-stamped proposals and poor due diligence [3][5]. Token-based voting systems can be manipulated by large holders who push self-serving deals. Additionally, short-term thinking by speculative token holders can pressure DAOs into quick, high-risk flips instead of long-term, well-considered investments [1][3].

To address these risks, DAOs are adopting more structured and proactive strategies.

Risk Mitigation and Compliance Strategies

DAOs are stepping up their game with stronger security and legal frameworks. For starters, smart contract security is a top priority. Professional audits by trusted firms, formal verification of critical code, and public bug-bounty programs are becoming standard for DAOs managing large treasuries [5][6]. Diversifying assets into stablecoins, using multisig wallets with hardware key requirements, and implementing role-based access controls are additional ways DAOs are safeguarding their funds [2][4].

On the legal front, many U.S.-focused DAOs are turning to legal wrapper entities like Delaware or Wyoming LLCs. These structures limit liability and simplify contracts, banking, and regulatory filings [1][3][7]. Operating agreements clarify on-chain and off-chain roles, dispute resolution, and liability protections. To navigate compliance while maintaining openness, DAOs are increasingly using KYC/AML processes at the funding stage. This might involve whitelists or third-party verification for contributors, while still allowing open governance participation for non-financial decisions.

Governance is also evolving. Instead of relying solely on "1 token = 1 vote", DAOs are introducing layered governance structures. These might include expert committees, delegated voting, or reputation-weighted systems to improve decision-making and deal evaluation [1][3]. Regular updates – such as quarterly reports with portfolio metrics and exit event details – help align with regulatory expectations and attract institutional investors. These investors, in turn, expect thorough financial and smart contract audits, with publicly available results [2][4].

Emerging Trends in DAO Venture Capital

The DAO venture capital space is advancing rapidly, driven by better compliance and security practices. Institutional interest is on the rise, as law firms, academics, and regulators begin to see DAOs as legitimate investment vehicles. This is encouraging the development of compliant structures and partnerships with professional service providers [1][3][7].

Hybrid models are becoming more common. Service DAOs and syndicate DAOs are teaming up with traditional VC funds to share resources like deal sourcing, due diligence, and network access, while keeping financial and regulatory risks within more conventional frameworks [1].

Technology is also reshaping the landscape. AI-driven analytics are helping DAOs improve deal sourcing and portfolio management by analyzing both on-chain and off-chain data. These tools are being used for tasks like sentiment analysis, monitoring protocol health, and detecting governance risks. Meanwhile, cross-chain and modular DAOs are emerging, enabling investments across multiple ecosystems. They use cross-chain bridges, multi-chain governance frameworks, and modular smart contracts to separate treasury, governance, and investment functions.

Specialization is another growing trend. Many venture DAOs are narrowing their focus to specific areas, such as AI-Web3 intersections, advanced cryptography, decentralized infrastructure, and Bitcoin-related tools. This targeted approach allows for deeper due diligence and better portfolio monitoring. For instance, firms like Bestla VC are leading the way by focusing on these niches while offering tailored legal structures for the web3 space.

As states like Wyoming introduce DAO-specific LLC statutes and security practices continue to improve, the lines between traditional venture capital and DAO-based models are beginning to blur. This creates exciting opportunities for investors who can navigate both worlds effectively.

Conclusion

DAO-based venture capital is redefining how early-stage Web3 investments are identified, evaluated, and managed. By integrating smart contracts with community-driven governance, these structures bring a new level of transparency and accessibility to the investment process [1][2][3]. They complement traditional venture capital, particularly in Web3-focused sectors where grassroots involvement and community alignment are essential. This shift paves the way for better risk management and creative growth strategies.

To succeed, DAOs must prioritize disciplined risk management and establish strong legal foundations, often through Delaware or Wyoming LLCs, to mitigate liability and ensure regulatory compliance [1][4]. Equally important are secure smart contracts, well-defined governance models, and adherence to KYC/AML requirements. Past security issues highlight the importance of rigorous smart contract audits and comprehensive legal safeguards [6].

Looking ahead, specialized venture DAOs are emerging, focusing on areas like AI-Web3, advanced cryptography, decentralized infrastructure, and Bitcoin. Hybrid models that combine professional VC expertise with decentralized capital are also gaining traction [1][3][4]. Bestla VC serves as a prime example, offering targeted investments in cutting-edge Web3 niches while providing the legal and operational frameworks necessary for DAO success.

For investors, founders, and developers, DAO venture capital opens doors to broader participation, aligns incentives, and fosters collaboration in the digital finance and infrastructure space. As highlighted earlier, transparency, community involvement, and compliance remain key pillars. Achieving success will require adopting professional practices such as audits, transparent reporting, and regulatory adherence, while preserving the community-first approach that defines DAOs [1][2][4]. As regulations become clearer and technology evolves, DAO venture capital is poised to transform how Web3 projects are funded and supported.

The future of venture investing is global, transparent, and community-driven. When coupled with strong legal, governance, and security practices, DAO models offer the potential for meaningful participation and attractive returns, ushering in a new era of democratized investing for the next wave of investors.

FAQs

What legal structures can help Venture DAOs manage risks effectively?

To handle risks effectively, Venture DAOs frequently opt for legal structures such as LLCs (Limited Liability Companies) or foundations within the United States. These setups offer protection against liability, streamline regulatory requirements, and establish a clear framework for governance and day-to-day operations.

Selecting the appropriate legal structure is a key step in minimizing risks and setting the stage for long-term success. Working with legal and financial professionals is essential to customize the structure to fit the unique needs and objectives of your DAO.

How do Venture DAOs stay compliant with U.S. securities laws?

Venture DAOs stay on the right side of U.S. securities laws by implementing strong legal frameworks and governance structures that align with regulatory requirements. This often involves detailed due diligence, structuring token offerings to fit within registration exemptions, and ensuring that their voting systems comply with legal standards.

To handle the intricacies of these regulations, many Venture DAOs partner with legal professionals who help shape their operations to reduce risks while encouraging growth. Staying compliant not only allows them to function smoothly within the U.S. but also helps establish credibility with members and investors.

What are the key advantages and challenges of joining a Venture DAO?

Participating in a Venture DAO comes with several important benefits. Members gain access to a broad spectrum of investment opportunities, often including cutting-edge, early-stage projects that might otherwise be out of reach. The collaborative nature of decision-making allows participants to pool their knowledge and insights, creating a dynamic environment where shared governance promotes transparency and leverages collective expertise.

That said, there are some challenges to consider. Managing a diverse group of contributors can be tricky, especially when disagreements arise during the decision-making process. On top of that, the regulatory landscape for DAOs remains uncertain, which can introduce potential risks. To avoid inefficiencies or mismanagement, establishing strong governance frameworks is critical. With careful planning and clear structures in place, many of these obstacles can be addressed effectively.